At Texas State, student debt for first-generation students has become a crisis, resulting in negative impacts on mental health and finances.

There are financial literacy workshops offered at Texas State, but that’s the bare minimum. It is not enough to only have resources available at a club fair on campus. First-generation students should be required to enroll in financial literacy programs to have the proper tools to maintain financial security.

First-generation students are not handed anything; they must navigate complicated financial aid processes and work to pay tuition, often without the privilege of having parents with the means to take on debt. These barriers can manifest into obstacles that lower their likelihood of academic success, as stated in the Journal of Multicultural Counseling and Development.

While Texas State offers some financial aid resources and budgeting workshops, these programs are often underutilized because students are unaware they exist.

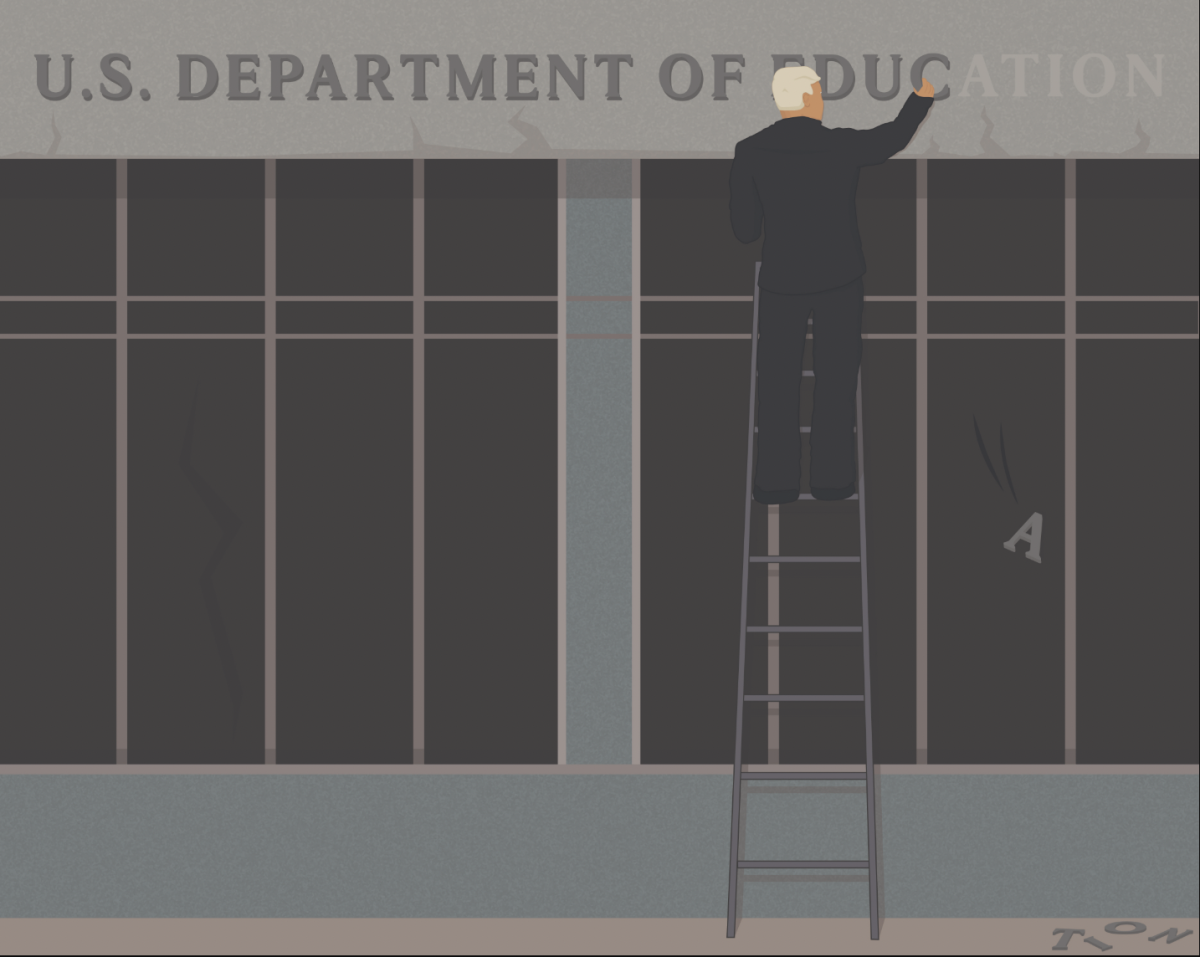

Higher education was never designed to cater to the needs of minority or first-generation students because of long-standing economic and racial disparities, as stated by the Brookings Institution.

Jae Franklin, vice president of the Texas State chapter of the National Association for the Advancement of Colored People (NAACP), said disparities further complicate financial aid for students from cultural backgrounds that are already historically oppressed.

“Students in such circumstances may have never had the guidance to navigate the process,” Franklin said. “Further, personal barriers and fears of failure or not wanting to disappoint the family that had to sacrifice stand in the way. Additional stressors of adjustment to a diverse university environment can take further tolls on mental and physical health.”

Many first-generation college students start college without proper knowledge of financial aid, student loans or the necessary vocabulary to make a life-altering investment.

According to The Institute for College Access & Success, “many low-income students must still borrow large sums to pay for college, even with financial aid.” This means loans are issued without a true understanding of the burden of debt.

The League for Innovation in the Community College states words like “subsidized” and “unsubsidized” can be misleading and lead to poor choices among students, which may hurt long-term stability when it comes to buying homes or cars in the future.

The stress of managing tight budgets, rising living expenses and growing debt can push students into “survival mode.”

Leah Longoria, health science junior, said as a first-generation student managing finances has added heightened stress on their college experience.

“The financial stress on campus is as important as any other mental health issues,” Longoria said. “Many times, I feel like if my parents went to college or if I came from generational wealth, then I wouldn’t be in survival mode. I could enjoy the college experience that Texas State promotes, like sororities and clubs that bring along lifetime friendships, instead of dealing with reality of what it’s really like for people who look like me.”

While some resources exist on campus, students do not take full advantage of them, nor do they have the tools to advocate for themselves. Without improved support, student debt will continue to burden first-generation students who strive for a better future.

–Aubrey Haynes is a public relations freshman

The University Star welcomes Letters to the Editor from its readers. All submissions are reviewed and considered by the Editor in Chief and Opinions Editor for publication. Not all letters are guaranteed for publication.