At its Sept. 17 meeting, the San Marcos City Council approved the city’s budget of more than $300 million for fiscal year (FY) 2025 and set the new tax rate amount.

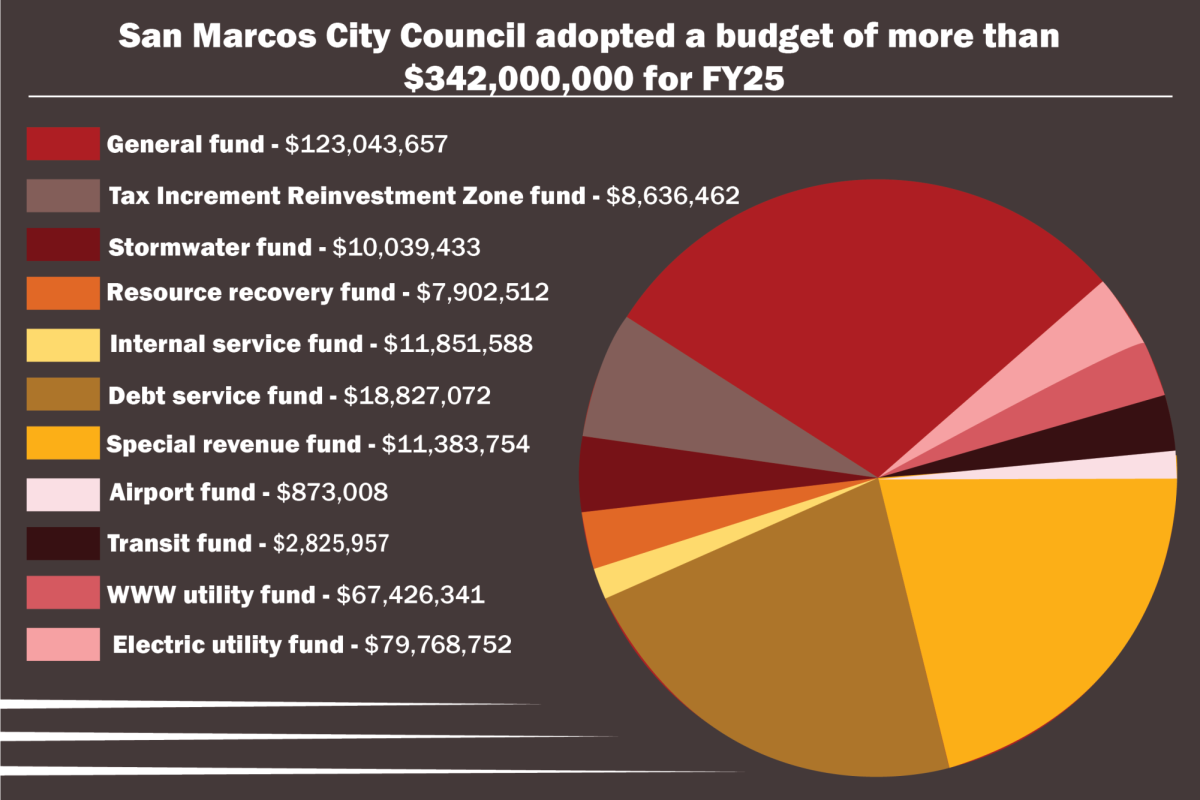

The adopted operation budget of $342 million is $21 million more than the adopted budget for FY 2024. The fiscal year will last from Oct. 1, 2024 through Sept. 20, 2025. Most of the increases for the $112.9 million general fund, which is the largest fund and supports core services of the city, are related to personnel and one-time uses of funds.

According to Mayor Jane Hughson at the Sept. 17 city council meeting, several years ago city council decided to increase their police and fire staffing.

“We’re closer than we have been [to being caught up] in such a long time,” Hughson said. “It’s allowing us to have more on our homeless outreach team and more mental health officers helping us reach a lot of goals that we have.”

Councilmember Jude Prather said at the Sept. 17 city council meeting the budget will help investments in city parks and infrastructure, such as the new San Marcos City Hall located across East Hopkins Street from the current city hall, while increasing public safety through additional personnel.

San Marcos’ FY 2025 general fund includes new positions added for city personnel such as police officer, crime analyst and master technician for emergency vehicles– there are a total of 14 new or reclassified positions. The general fund also set aside a total of $4 million for the new city hall.

San Marcos’ property tax rate for FY 2025 is 60.30 cents per each $100 of taxable real property, which will be lower than the no-new-revenue tax rate. According to the Texas Comptroller, the no-new-revenue tax rate is the rate that generates the same amount of tax revenue for the city from properties taxed in both the current and previous fiscal years.

As the current property tax rate is below the no-new-revenue tax rate, there is a loss of potential revenue for the city because San Marcos hasn’t set a tax rate below the no-new-revenue rate since 2013.

“Usually you’re at least trying to bring in an equal amount [of tax revenue] to what you brought in the prior year or even below it,” San Marcos City Manager Stephanie Reyes said at the Sept. 17 city council meeting. “The taxpayer is who’s benefiting here.”

At the meeting, Councilmember Mark Gleason said tax revenue can remain stable despite bringing in less money because San Marcos’ expansion generates additional revenue, reducing the burden on individual taxpayers.

The population of San Marcos in 2023 was 87,111 according to Josh Daspit, associate professor of management at Texas State, compared to 67,553 in 2020 as reported by the U.S. Census Bureau.

Matthew Flynn, assistant professor of finance at Texas State, said for cities, taxes can be a balancing act between the benefits of getting more revenue while not causing residents to leave.

“Municipalities are going to be reluctant to raise taxes because they want to create an attractive environment for businesses and people to come in and move there,” Flynn said. “Ultimately that’s going to be your main revenue driver is if you have more people in the area.”

While property tax rates stayed the same since last year, the rates for SMTX Utilities and Resource Recovery went up by $13.46 on average from last year, a 5.5% increase. SMTX Utilities includes electric, water and wastewater.

According to Director of Finance for San Marcos Jon Locke at the Sept. 3 city council meeting, the Citizen Utility Advisory Board recommended the 5.5% rate increase for electric rates to exceed the legal minimum for Debt Service Coverage on July 25.

The Debt Service Coverage measures the amount of operating revenue needed to cover debt. According to the Texas Bond Review Board Data Center, San Marcos is currently $471,800,000 in debt.

Tristen Pride, an urban and regional planning senior, said despite having a history of struggling to meet his utility payments, he thinks the city is ultimately doing the right thing to keep up with their profit margins with inflation but wishes the city would be more aggressive in recouping their sales tax deficit.

“Any time that they raise their price [of utilities], it should always come with educational materials on the city’s existing [financial assistance] programs created for this,” Pride said.