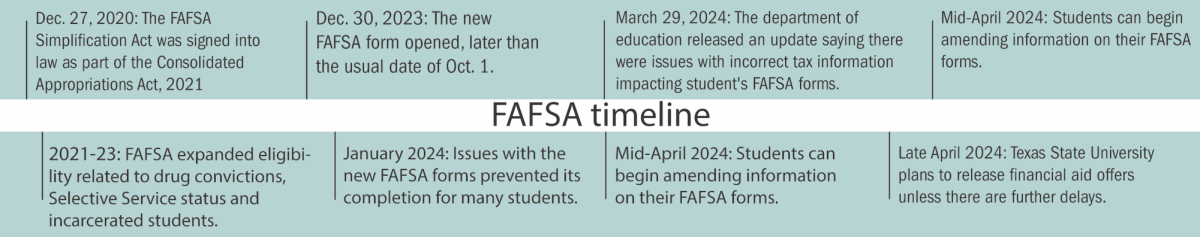

The federal Department of Education announced issues related to tax data that could delay the financial aid process for students.

According to the announcement on March 29, the issue was caused by errors in tax data sent to the Department of Education by the Internal Revenue Service (IRS) and is estimated to impact less than 20% of Free Application for Federal Student Aid (FAFSA) applications.

“We recognize how important it is for schools and families to have the information they need to package and receive aid offers,” the announcement stated. “Accordingly, we will continue our joint efforts with IRS to resolve these issues and implement updates to resolve data inaccuracies as expeditiously as possible.”

Nina Guidroz, a psychology freshman, said due to an error involving her FAFSA form being submitted without her signature, she is currently being told she will receive no financial aid this year.

“When I went back to make that correction of adding my signature [FAFSA] wouldn’t let me,” Guidroz said. “The [Department of Education] said I had to wait because other students have to have their figures and their complaints processed to make corrections.”

According to Texas State’s Assistant Vice President of Financial Aid and Scholarships Christopher Murr, Texas State expects the impacts to be minimal, with plans to send out financial aid offers late April.

Murr said while he is optimistic about the current timeline, the Department of Education could announce additional errors that cause even further delays.

“If [another] situation arises we’re going to have to assess and address the situation as effectively as we can,” Murr said. “Our main goal is to get students timely and accurate financial aid offers notices so students can budget and prepare for the upcoming fall semester.”

Murr said even after financial aid offers are sent to students, the amount may be subject to change based on updates from the Department of Education.

“The hope from [the Department of Education] and other institutions is once we send out letters this month we won’t be in a situation where we have to make revisions,” Murr said.

Guidroz said she relies on her financial aid to pay for classes and the issues with her FASFA form are causing her to stress about registering for classes.

“I don’t want to use private loans, that’s my last resort,” Guidroz said. “If I am unsuccessful [with FAFSA] then I may take out a private loan.”

To remain up to date with announcements regarding the FAFSA form visit the Department of Education’s website.