In August 2022, the White House administration announced a plan for student loan forgiveness, but lawsuits piled up and eventually struck the plan down.

On June 30, the U.S. Supreme Court ruled the loan forgiveness plan, Biden v. Nebraska, unconstitutional.

“It was not surprising in that the states that were suing claim that they were going to be damaged,” Dr. William Chittenden, an associate professor of finance, said.

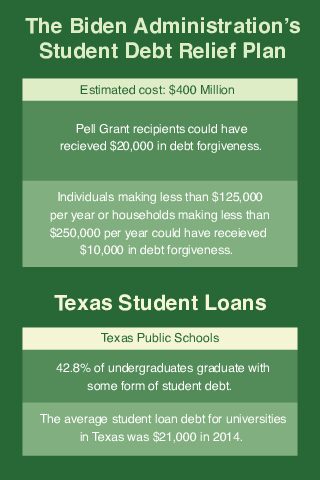

Under the plan, borrowers who made less than $125,000 a year, or $250,000 per household, would have received up to $10,000 in forgiveness. Recipients of a Pell Grant would have received up to $20,000 in forgiveness.

“About half of the borrowers would have been completely student debt free, had the president’s original plan gone through,” Chittenden said.

According to Texas State President Kelly Damphousse, the average Texas State student graduates with around $25,000 in student loan debt. According to Forbes, the average student debt in Texas is $32,285, meaning Texas State students graduate with around $7,000 less in student debt than the state average.

“The average student at Texas State graduates with $25,000 in student loans, that’s less than the price of a car,” Damphousse said. “That number… is only students who have student loans. We have a lot of people who graduate with no debt at all, so if you calculate those, the average student loan debt is even lower than $25,000.”

The plan for student loans was controversial, not just legally, but among the general population. A lot of students and graduates saw the forgiveness plan as a great help, especially after the shakeup that was COVID-19.

“I think forgiveness should be granted. I started school during the pandemic, and it wasn’t what I expected,” Christopher Markgraph, a Texas State alumni, said. “I have a good chunk in loans, so [student debt forgiveness] would have been a massive help.”

Among older alumni, fears of the impacts on the economy and a sense that paying off your debt is the right thing to do made debt forgiveness less popular.

“[COVID-19] was a bad time. There were a lot of economic woes. People had difficulty. Small businesses were shut down. School went all online. As a teacher myself, I see the gaps in learning, so I understand that there was a need for [student debt relief],” Donnie Bishop, a graduate of then Southwest Texas State University, and father of two students with student loans, said. “To me, I had to pay for all my loans. I went through tough times – not a pandemic, but tough times. We’re already trillions of dollars in debt, I just don’t think we should do it.”

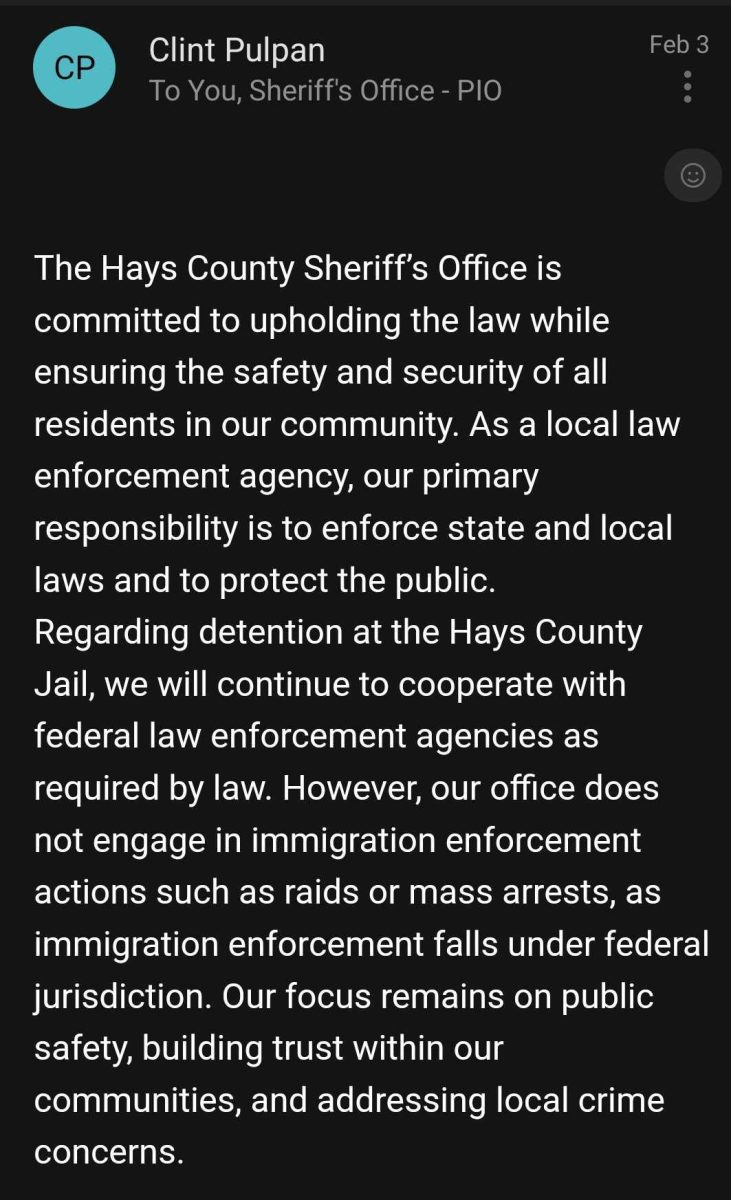

The cancellation of student loans comes during an uncertain time for many borrowers across the country. According to Chittenden, student loans will begin accruing interest again, and payments will be due in October for the first time in three years.

“Not only does interest start on Sept. 1, but payments begin again in October,” Chittenden said. “And again, that’s two, three, four, even $500 that you don’t have to spend on food, clothing, shelter, going out, etc. ”

On July 14, just days after the Supreme Court decision was released, the White House administration announced a new plan for forgiveness for those using income-driven repayment. The full plan can be found on the Department of Education’s website.

“If you make your payments [on time] for 10-to-20 years, based on what your income level is, then any balances at the end will be forgiven,” Chittenden said. “In addition, any extra interest is not going to be added to your account.”

According to the Biden administration, the new plan will forgive over $100 billion in debt across more than 3.4 million borrowers in the coming months

Jordan • Sep 20, 2023 at 5:25 pm

If students were more aware of scholarships options, they would not need student loans or need smaller quantities of loans. This is no fault to students but to education administrations. Scholarships are abundant, available through universities and online scholarship websites. While they may not pay for every aspect of tuition, they will help. And any help is better than no help. It is unfortunate that many people struggle with paying these back. However, society can’t keep living with a “give me what I want” mentality. Additionally, if student loans were payed off by the government, this would come back to bite us and future generations in the form of increased tax rates. There is always a consequence for every action, positive or negative.

Peggy • Aug 25, 2023 at 8:43 am

The student that had their loan for over 10 years needs the help . They can not pay the loan without doing without toward their family needs. I think it should be a more hard for student to get the student loan more money on the Pell to help our student.

Noneofyourbusiness • Aug 25, 2023 at 7:41 am

It’s absolutely sad how Republicans went all the way to Supreme Court to block student loan forgiveness to help young people in America who needed this support! PPP loans were given out for Americans with businesses and they sold the business and used the money fraudulently! Big banks and the car industry were also bailed out! To top that off, our country has given billions of dollars of aid to Ukraine! But when it comes to helping its own country, young law abiding students, who are diligently working in the community to better themselves, they fight tooth and nail, not to help them! I hope each one of them remembers how our country treated them when it’s time for elections!

Teresa N. Shoemaker • Aug 24, 2023 at 8:54 pm

My grown son attened college. Why is Fed Loan after me???

Gloria A Carter • Aug 24, 2023 at 8:33 pm

Help. Just need help.

Marcel • Aug 24, 2023 at 7:40 pm

I think that being a nurse we should have something forgiven. We were there putting our own ass on the line. I was in school for the first part of it but I worked as a tech through the whole thing while in school. It was hard to come home to my family wondering if I was going to expose them or if I had been exposed myself. I hope they read this because alot of us were affected more then others. People got to work from home. We had to go in and face our fears.

Mary • Aug 24, 2023 at 7:25 pm

I sold my house knowing I could not afford a mortgage and student loan payments. I had Pell grants and loans. I hope I could get something back.

Regards

Patrick • Aug 24, 2023 at 1:56 pm

Why are these loans spoken of as legitimate? FAFSA is incomplete credit check. Student loans are GRANTED with no consumer protections. Government has no fear of making a “bad loan” and losing the money as a bank or credit card company would. One sided.