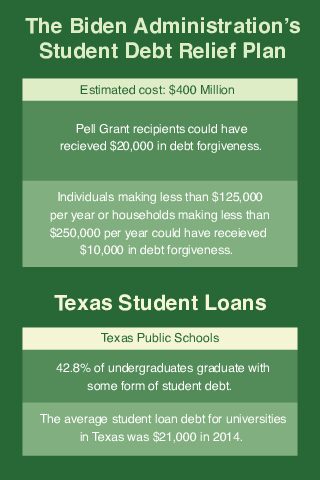

In August 2022, the White House administration announced a plan for student loan forgiveness, but lawsuits piled up and eventually struck the plan down.

On June 30, the U.S. Supreme Court ruled the loan forgiveness plan, Biden v. Nebraska, unconstitutional.

“It was not surprising in that the states that were suing claim that they were going to be damaged,” Dr. William Chittenden, an associate professor of finance, said.

Under the plan, borrowers who made less than $125,000 a year, or $250,000 per household, would have received up to $10,000 in forgiveness. Recipients of a Pell Grant would have received up to $20,000 in forgiveness.

“About half of the borrowers would have been completely student debt free, had the president’s original plan gone through,” Chittenden said.

According to Texas State President Kelly Damphousse, the average Texas State student graduates with around $25,000 in student loan debt. According to Forbes, the average student debt in Texas is $32,285, meaning Texas State students graduate with around $7,000 less in student debt than the state average.

“The average student at Texas State graduates with $25,000 in student loans, that’s less than the price of a car,” Damphousse said. “That number… is only students who have student loans. We have a lot of people who graduate with no debt at all, so if you calculate those, the average student loan debt is even lower than $25,000.”

The plan for student loans was controversial, not just legally, but among the general population. A lot of students and graduates saw the forgiveness plan as a great help, especially after the shakeup that was COVID-19.

“I think forgiveness should be granted. I started school during the pandemic, and it wasn’t what I expected,” Christopher Markgraph, a Texas State alumni, said. “I have a good chunk in loans, so [student debt forgiveness] would have been a massive help.”

Among older alumni, fears of the impacts on the economy and a sense that paying off your debt is the right thing to do made debt forgiveness less popular.

“[COVID-19] was a bad time. There were a lot of economic woes. People had difficulty. Small businesses were shut down. School went all online. As a teacher myself, I see the gaps in learning, so I understand that there was a need for [student debt relief],” Donnie Bishop, a graduate of then Southwest Texas State University, and father of two students with student loans, said. “To me, I had to pay for all my loans. I went through tough times – not a pandemic, but tough times. We’re already trillions of dollars in debt, I just don’t think we should do it.”

The cancellation of student loans comes during an uncertain time for many borrowers across the country. According to Chittenden, student loans will begin accruing interest again, and payments will be due in October for the first time in three years.

“Not only does interest start on Sept. 1, but payments begin again in October,” Chittenden said. “And again, that’s two, three, four, even $500 that you don’t have to spend on food, clothing, shelter, going out, etc. ”

On July 14, just days after the Supreme Court decision was released, the White House administration announced a new plan for forgiveness for those using income-driven repayment. The full plan can be found on the Department of Education’s website.

“If you make your payments [on time] for 10-to-20 years, based on what your income level is, then any balances at the end will be forgiven,” Chittenden said. “In addition, any extra interest is not going to be added to your account.”

According to the Biden administration, the new plan will forgive over $100 billion in debt across more than 3.4 million borrowers in the coming months