The Consumer Financial Protection Bureau (CFPB) announced a proposal to cap the overdraft fees banks are allowed to charge its clients.

The proposal was made public on Jan. 17 and comes as part of the Biden Administration’s crackdown on fees. It would rework how overdraft fees are handled, possibly capping them as low as $3.

“The proposal would close an outdated loophole that exempts overdraft lending services from longstanding provisions of the Truth in Lending Act and other consumer financial protection laws,” the CFPB statement said. “For decades, large financial institutions have been able to issue highly profitable overdraft loans, which have garnered them billions of dollars in revenue annually.”

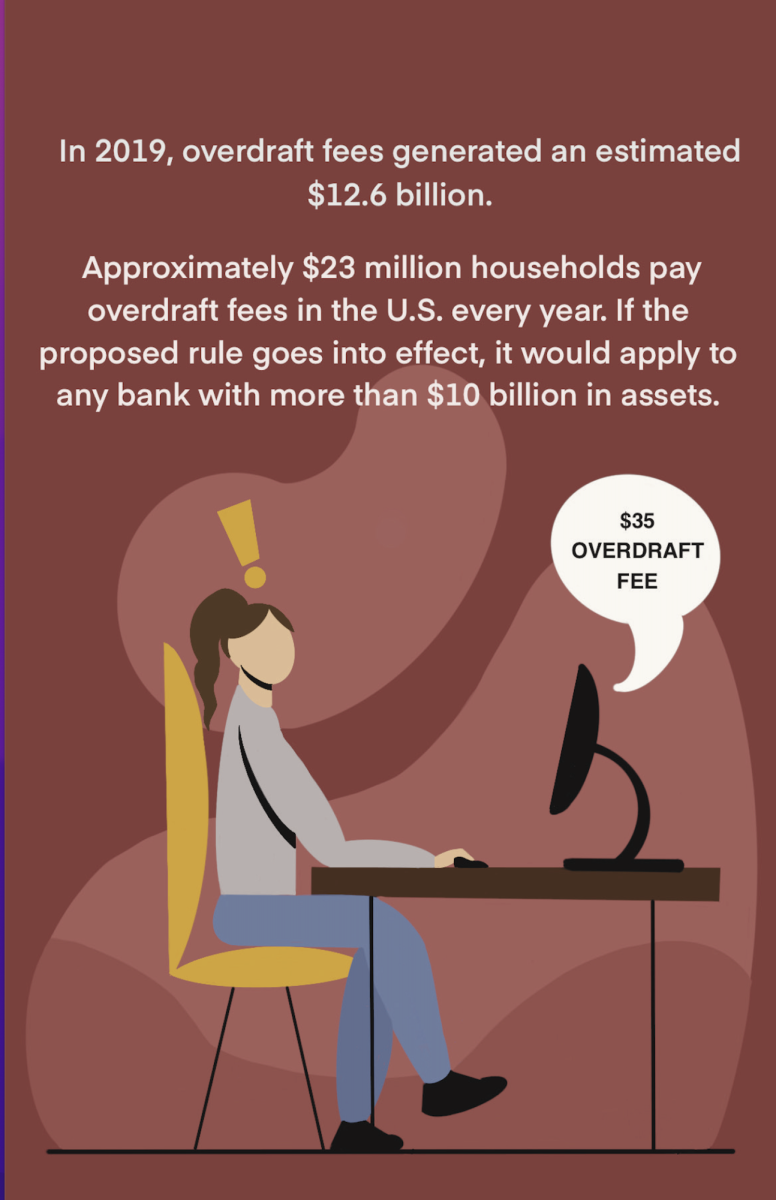

Banks charge overdraft fees when someone spends more money than available in their account, resulting in a negative balance. According to the CFPB statement, most banks currently charge a $35 overdraft fee and approximately 23 million households pay overdraft fees at least once a year.

According to the proposal, any ruling would apply to financial institutions, such as banks and credit unions, that manage more than $10 billion in assets. The CFPB said this would cover the 175 largest banks and credit unions in the country.

While the CFPB said overdraft fees are junk fees, Dr. William Chittenden, an associate professor of finance at Texas State and the president and CEO of the Southwestern School of Banking, doesn’t agree with this statement.

“A junk fee is a fee that’s not disclosed upfront,” Chittenden said. “So you go to a hotel and they tell you the room rate is $40 a night, but there’s a $100 resort fee that’s mandatory, so a room is really $140 a night. That’s a junk fee. Overdraft fees aren’t hidden.”

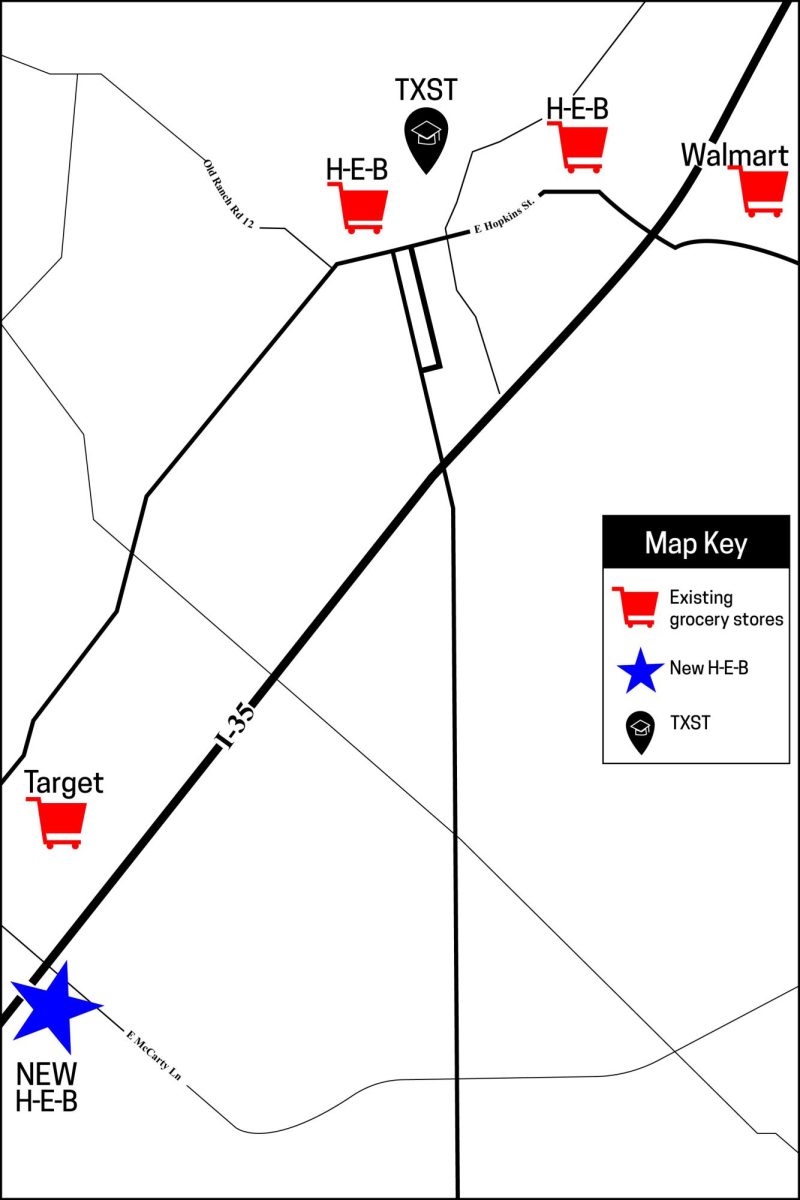

In 2022 Wells Fargo, which has a branch in the LBJ Student Center, was fined $3.7 billion by the CFPB for charging overdraft fees even when an account had the funds to cover the transaction that triggered the fee.

According the CFPB, Wells Fargo made over $1.2 billion from charging overdraft fees in 2022, which was the highest of any bank in America.

Texas State students can use their BobcatCard as a debit card by connecting it to a Wells Fargo checking account. According to Wells Fargo, currently students will not be charged a fee for one overdraft and every instance after will cost $35 each. With the federal proposal, that charge could drop to $3 for students.

Overdraft protection is a service banks offer where instead of denying charges leading to a negative account balance, banks allow the balance to go negative, while charging a fee for each additional transaction.

According to the CFPB release, the proposed rule could save consumers $3.5 billion a year, but Chittenden said the change could cause banks to stop offering overdraft protection.

“If there’s not enough potential profit in those overdraft fees then [banks] are not going to offer [overdraft protection],” Chittenden said. “Instead of the bank, in essence giving you a short-term loan, and the cost of that loan is your overdraft fee, you simply won’t be able to to spend negative balances.”

Chittenden’s concerns about banks withholding overdraft protection were backed by a statement from the American Bankers Association (ABA), a trade association for banks.

“In an effort to score political points, the CFPB is seeking to eliminate a valuable service and push consumers who need overdraft protection into the hands of less-regulated, more-costly alternatives,” the ABA’s statement said.

Data from the Bureau of Labor Statistics shows weekly income is lowest at ages 16-24, and data from the National Center for Educational Statistics shows the majority of full-time college students do not work full time jobs. This means that on average, college students are lower income earners.

“Students often fall into that demographic that’s more likely to need overdraft protection,” Chittenden said.

The proposal is still in its early stages and is open for comment to the CFPB until April 1.