Student loan debt often makes headlines but omits the increasing debt of graduate school, requiring more financing tactics from students.

Currently, the annual student loan debt for graduate schools across the U.S. is $37 billion and 40% of all federal student loans are used for graduate studies each year, a 2020 report from the Center for American Progress states.

Takia Bunton, social work graduate student, did not think she could qualify for financial aid as a graduate student, especially since she already took out loans as an undergraduate. Today, Bunton is using loans again to finance her studies as she struggles to make payments while studying and working full-time. Her total for undergraduate and graduate loans estimates around $60,000.

Bunton said she took out loans again for graduate school despite fellow undergraduate students believing it was not possible.

“During undergrad, I was told just by my peers that you couldn’t take out student loans again for graduate school, so it probably is a common misconception. I just ended up doing it anyway just to see if I would get the financial aid, and I was able,” Bunton said.

Bunton said she tried to get a second job but decided against it, believing it would be too hard to manage alongside her studies. Instead, she is now using loans with saved up money to manage her tuition and rent.

“It’s hard for me,” Bunton said. “I’m trying to make payments while I’m in school as a full-time student and working full time and then having to make payments so I’m not extremely overwhelmed once I graduate. It does cause some stress.”

Dean of the Graduate College Andrea Golato said students borrowing federal student loans who receive a graduate degree—either Masters or Ph. D—at Texas State graduate with an average debt of $34,534.

“It’s always more expensive to get a medical degree or a degree in law, and that has to do with both the length of studies and how many semesters you have to study in order to obtain your degree. Also, different schools charge different amounts in tuition. Stanford University will charge way more tuition because it’s a private university rather than a public university,” Golato said. “We do not have medical degrees or law degrees and our tuition is relatively cheap in comparison to other universities.”

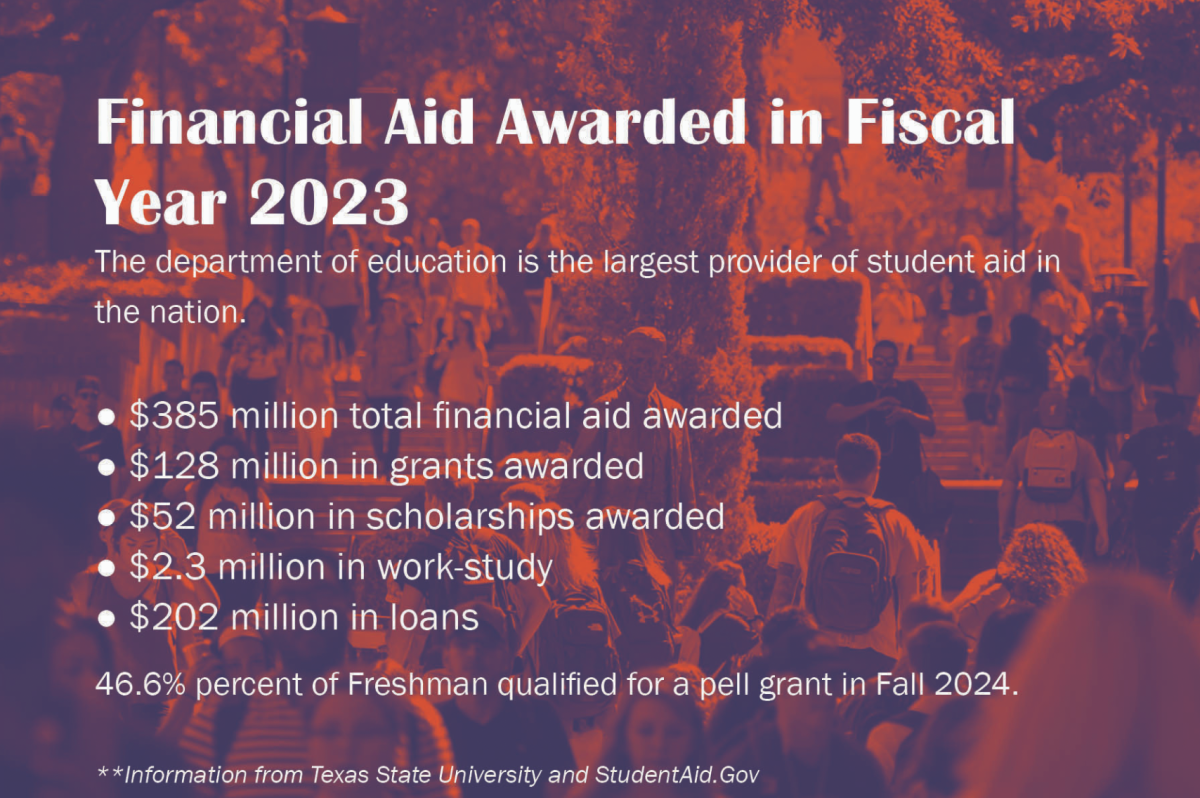

Financial Aid and Scholarship Associate Director Dede Gonzales said 8.6% of the financial aid from the university 2018-2019 was given out to graduate students. Gonzales also said there are fewer grant opportunities for graduate students, like the Pell Grant or the Federal Supplemental Educational Opportunity Grant, forcing graduate students to rely more on loans.

“There is more of a reliance on loans for graduate students because there’s a lesser availability of things like federal Pell Grants,” Gonzales said. “But last year overall at Texas State 11% of our loan volume was graduate students and graduate students also made up 10% of the headcount so it doesn’t seem disproportionate.”

The current debt system allows independent graduate students to take out loans at a capped amount of $138,500 for both subsidized and unsubsidized loans for the entirety of their studies. In contrast, undergraduate students can only take out loans up to $57,500.

The Center for American Progress writes that 40% of loan balances over $60,000 are repaid using income-driven repayment, or IDR, which are based on the borrower’s income. This leads to concerns that debt levels are unmanageable and likely to drag borrowers for years or even decades. Interest can continuously increase the payment balance despite borrowers making timely payments.

Golato said there are many opportunities apart from loans for students to alleviate the financial burden of graduate studies. Those paid opportunities include graduate assistantships, travel funds, scholarships and fellowships, financial aid and loans, external funding and awards. More information on how to qualify or apply for each opportunity can be found on the Graduate College’s funding page.

“When I was a graduate student here in the United States, I was a teaching assistant for German so I taught beginner German,” Golato said. “About a quarter of all graduate students, around 1,000 of them, are funded by graduate assistantships. A lot of those graduate students, actually about 50%, are part-time students because they are working adults.”

Between June 2018 and May 2019, 96 graduate students applied for external funding totaling to $4.5 million and 21 of those students were awarded a total of $650,000, a 29% increase in awards from 2017-2018. Since 2016, graduate students applied for more than $8 million in external funding and received more than $1.5 million.

According to Golato, the majority of graduate students at Texas State are already Texas residents and therefore benefit from in-state tuition. However, Golato also said international and out-of-state students who have an assistantship or receive a scholarship can qualify for in-state tuition as well.

The rise in graduate debt also presents itself differently across the social spectrum. According to the Center for American Progress, black students are more likely to borrow in graduate school, and their median debt once completed can be up to 50% higher than white students. Women with graduate degrees often get paid the same as a male peer with a lesser degree and will eventually end up paying more for those credentials over time.

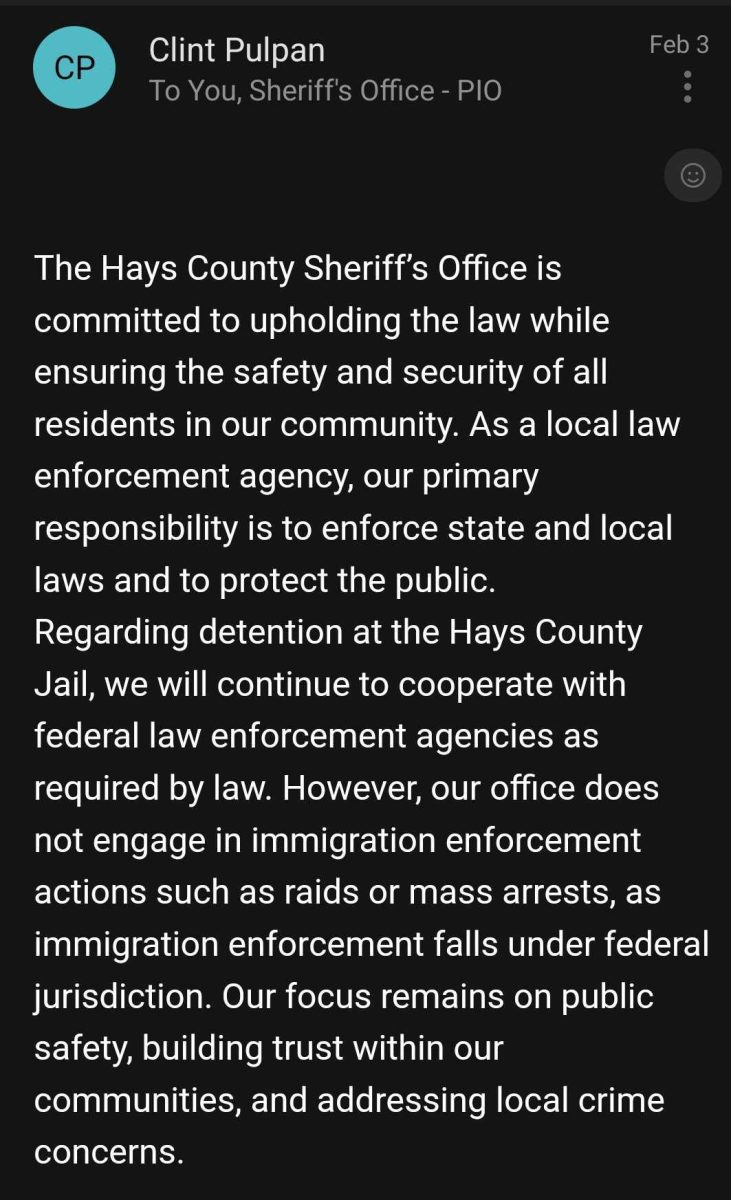

Gonzales said the university offers prospective graduate students financial advice when seeking to attend Texas State for one of their graduate programs, free of charge.

“If a student needed help with financial coaching from a certified financial adviser, that’s offered to students free of charge for the university so that’s a tool that they could use to help plan out how to pay for graduate education,” Gonzales said. “There’s also something in there called Your Loans, which is where a student could go at any point in time and see the amount of loans that they have and so just kind of keep tabs on ‘where am I in my borrowing’ so those are all resources that graduate students could use.”

Both undergraduate and graduate students have free access to certified financial advisers through Texas State’s Bobcat Gold program.

Categories:

Graduate studies debt overwhelms students

February 4, 2020

The Graduate College, located in JCK 280, offers workshops and webinars for graduate students and interested undergraduates looking to apply for grants and external funding.

0

Donate to The University Star

Your donation will support the student journalists of Texas State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover