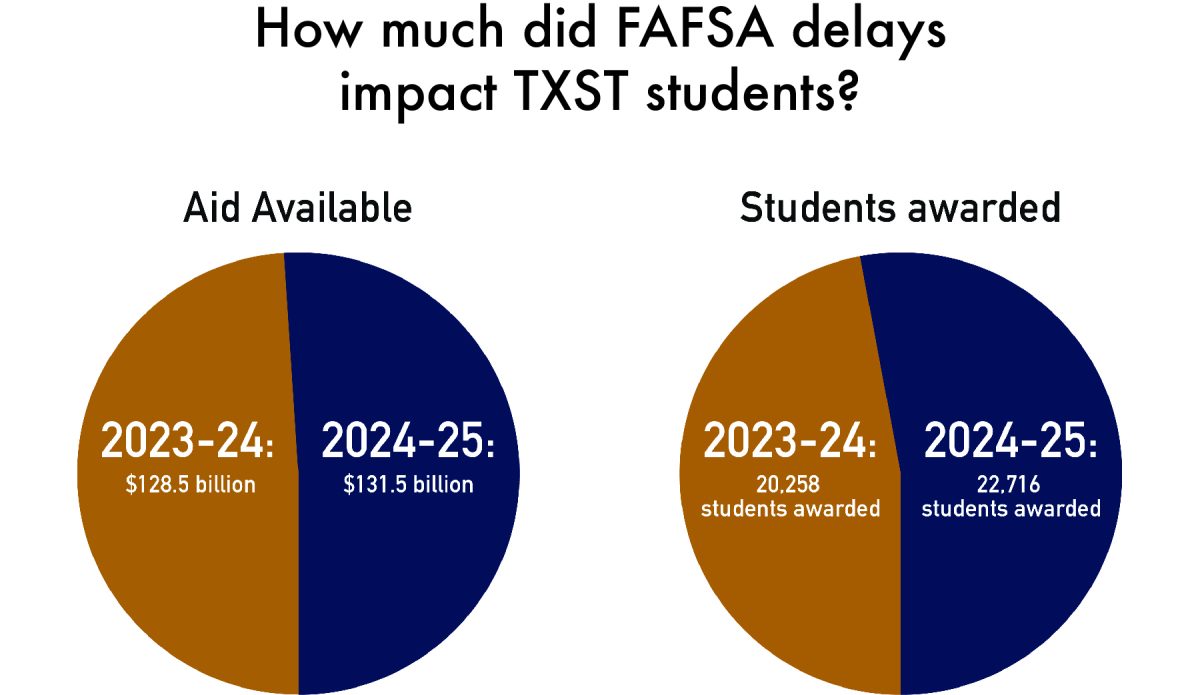

Despite issues with the roll-out of the new Free Application for Federal Student Aid (FAFSA) for the 2024-25 school year, Texas State saw an increase in financial aid money awarded to students.

The increase in the number of students who were awarded aid this school year surpassed the increase in number of students enrolled. According to a Sept. 12 announcement by Texas State, enrollment increased by 1,805 students, which is about 75% of the increase in students awarded.

“So there’s $131.5 million that was made available and that was $4.3 million more than last year, or a 3.4% increase,” Vice President of Financial Aid and Scholarships Christopher Murr said.

The new financial aid form was meant to make the process easier for students and expand financial aid coverage. Instead, the form was plagued by issues such as a delayed launch, delayed reports to universities and issues with tax data.

“[We receive] data typically in October, prior to the start of the academic year. And this year, we did not receive that data from the Department of Education until early April,” Murr said.

According to Murr, the changes presented issues to students and the university, which prompted them to move the priority admissions deadline.

“We were very stressed [with students] inability to access and complete the FAFSA, and that’s why you saw the university, for instance, extend its priority deadline from March 15 to April 15,” Murr said.

Despite the university’s efforts and an increase in the amount of aid awarded, some students were still impacted by issues with the new FAFSA form, with some questioning if they would receive aid in time to enroll in fall classes. Jayne Sanchez, a public relations freshman said that she didn’t have her financial aid figured out going into the semester.

“They opened [FAFSA] late this year, like the whole thing changed this year, where they went from October to December,” Sanchez said. “So I did it very early in January.”

Sanchez said that frustrations and delays with FAFSA have forced her to seek other methods to pay for her tuition and housing.

“As of right now, my parents are splitting it, so we’re paying the 25% [down payment] and then they’re just going to split it and put it on the credit card and then I’m going to try to pay them,” Sanchez said.

Sanchez was not the only student who was unable to complete her FAFSA form. According to the National College Attainment Network (NCAN), as of Nov. 1, there was an 8.8% decrease in FAFSA completion for the 2024-25 school year.

“Through Nov. 1, 2024, 53.4% of the high school class of 2024 has completed a FAFSA. There have been 2,224,789 completions nationally, a -8.8% change compared to last year,” NCAN wrote on their FAFSA tracker page.

According to the Department of Education’s website, there have been more issues with FAFSA during the fall 2024 semester. Their website shows fixes and “workarounds” for issues posted as recently as Oct. 18.

The most recent issues include being unable to reopen the form for married students, not being prompted to sign and incorrectly displaying a completed application as “in progress,” among others.

“Certain populations, simply couldn’t access and complete the FAFSA,” Murr said. “In fact, some of the ability to make mass changes with the Department of Education on behalf of our students and updating files is not even available to us.”

Sanchez said she strongly recommends that other students don’t delay their FAFSA application.

“There’s a lot of lessons to learn from this,” Sanchez said. “If I were to tell like the seniors right now is, don’t put FAFSA off. If it doesn’t get processed or doesn’t want to get submitted or anything like that, don’t hold off on calling. Don’t hold off on trying to fix the issue.”