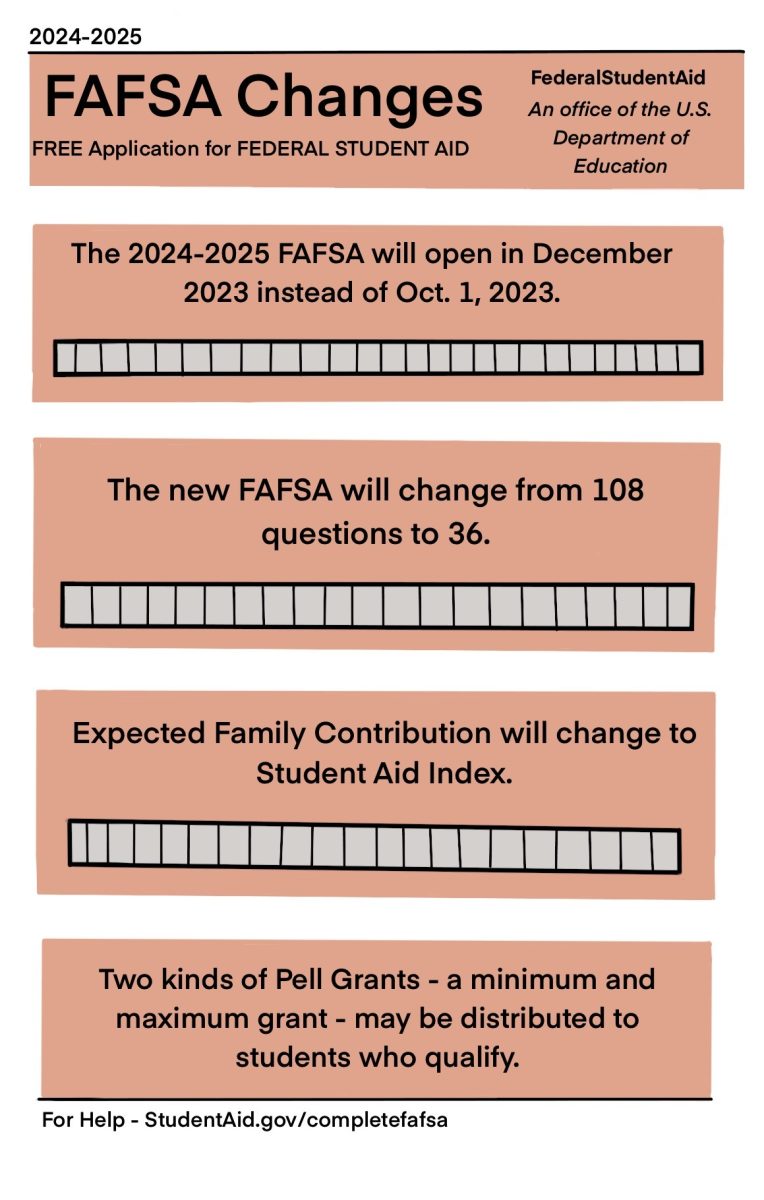

The Free Application for Federal Student Aid (FAFSA) form is implementing new changes for the 2024-25 year.

Through the FAFSA Simplification Act, the Department of Education over the past three years has implemented changes to the form. The final changes include replacing the Expected Family Contribution (EFC) with the Student Aid Index (SAI), expanding the access to Federal Pell Grants and overall streamlining of the form.

The FAFSA is a form for college students to determine their eligibility for federal financial aid through inputting a variety of information, such as tax returns, W-2 forms and other records of money earned into a formula that calculates a student’s EFC or now SAI score, which then determines the student’s eligibility.

Because of the major changes in the FAFSA, forms will open in December 2023 as opposed to Oct. 1. Following years’ forms will continue to open on Oct. 1.

The EFC is a measure of the student and their families’ expected contribution towards the cost of education. The new form will replace the EFC with the SAI. The SAI will now be the single factor that determines a student’s eligibility for a Federal Pell Grant.

“The SAI is [largely] a name change. With that there’s a little calculation change [and] there’s a goal of having more students Pell [Grant] eligible,” Byron Kerr, assistant director for financial aid and scholarship outreach, said.

The definition of family size will change to reflect the number of dependents reported by the applicant’s parents or the applicant if independent. Generally, a student is considered a dependent if they’re reliant on their parents for financial support.

These changes are intended to better reflect what is reported on the student or parent’s tax returns. This will be implemented through the new formulas in the FAFSA form.

Federal Pell Grants, grants normally awarded to students with exceptional financial need, will be made available for more students. Incarcerated students will now be able to receive Pell Grants and eligibility will be restored to students whose schools closed.

The act will also work to streamline the FAFSA, through the changing of questions and directly receiving data from the Internal Revenue Service, whereas before the data was transferred by the student. Some question changes include no longer asking about selective service and drug convictions and adding questions about sex, race and ethnicity.

“I’ve seen [the new form], it looks really nice… With some luck it will make it easier for more students to get financial aid and go to college,” Kerr said.

With the form lowering the amount of questions, students like Nick Moore, an exploratory junior, hope that it will be easier to complete than years past.

“I’m happy to hear they’re changing the form. It’s always been a hassle to fill out,” Moore said.

FAFSA is designed to support students in need of financial aid. Not all students in need of aid, however, will qualify for support. For such students, Kerr stresses the importance of communication with the financial aid office and working towards scholarships.

William Chittenden, associate professor of finance, advises all students, especially those with loans, to stay on-top of their personal finances.

“Learn how to make a basic monthly budget for your household,” Chittenden said. “Take into account what your earning potential is going to be when you graduate and how much debt you’ll take on…. The consequences of not paying it [are] you get trapped and then it’s going to make it difficult for you to borrow and get any kind of credit in the future.”

For more information, visit its website.