Taxes are unavoidable no matter where you live. As Benjamin Franklin said, “nothing is certain except death and taxes.” But if we all have to do taxes, why is the American tax filing system so horribly inefficient?

Millions of Americans every year struggle to do their taxes on time. Citizens with lower incomes will need to find a free filing service or work their way through the forms themselves. Citizens with higher incomes must ensure that everything is accounted for, which may involve hiring an accountant or purchasing a filing service.

College students often face their own unique set of issues as inexperienced taxpayers; they must learn how to file properly, as well as coordinate with their families about how they will be accounted for on their taxes.

Though there have been a few services available to both Texas State students and the San Marcos community, such as the VITA Tax Clinic held in the LBJ Student Center for those who made less than $57,000 last year, and tax preparation software provided to international students through International Student and Scholar Services (ISSS), there is still a sense of confusion about taxes among students.

According to the Tax Foundation, students do not always file for many deductions that they are eligible for; 27% of eligible tax filers did not claim available tax credits or tuition deductions, resulting in a missed reduction tax liability of $169 on average.

No matter what walk of life they are from, each American has to face a set of hurdles to ensure that their taxes are filed correctly, and if they make a mistake, they can possibly face an audit, or in extreme cases fines and criminal charges.

While the average age of people convicted and sentenced for tax evasion was 50 years old, people of any age, including college students, can raise concerns of interest to the IRS, and those found guilty of evading or defrauding the IRS can face up to $100,000 in fines, up to five years in prison and the cost of prosecution. Considering how high the stakes are for all participants, we should just have a system that is simpler for people of all income levels.

Other countries have simpler systems, so it is not impossible. In Sweden, taxes allegedly can be completed in under 10 minutes via text message, a system that has, according to economist Andreas Hatzigeorgiou, made the tax authority one of the most popular government entities in Sweden. This is a far cry from the American system, where Americans loathe the IRS, and not without reason.

The IRS is notoriously difficult to get ahold of in the event of a mistake. While it may not be possible to immediately switch over to a text message tax filing system, having a more uniform method of filing taxes will help taxpayers spot and correct mistakes, as well as avoid hours of locating and typing in tax forms.

In addition to the frustration Americans have with the IRS, the American tax season causes great distress to the accountants between the citizens and the government, which not only puts an undue burden on an entire profession but also increases the opportunity for mistakes. It is well known that accountants feel the squeeze every tax season as the turnover rate for accountants for small firms was 15 to 20% and that was before the pandemic, and the Great Resignation. When one googles “accountant tax season burnout,” they are greeted with 1,630,000 results, many of which are articles reminding accountants to take time for themselves and practice self-care.

The long hours, extreme stress and general frustration around the topic from both clients and colleagues can lead to burnout, the symptoms of which include insomnia, disinterest in work, a decrease in efficiency and quality of performance and difficulty concentrating. Not only can this be extremely taxing mentally, but it can also lead to an increased number of mistakes in their work, which can only exacerbate the already fraught workplace and relationship with clients and the government. Tax reform would help reduce the high levels of tension in the accounting industry, as well as reduce the turnover rates at a time when it is already difficult for employers to find workers.

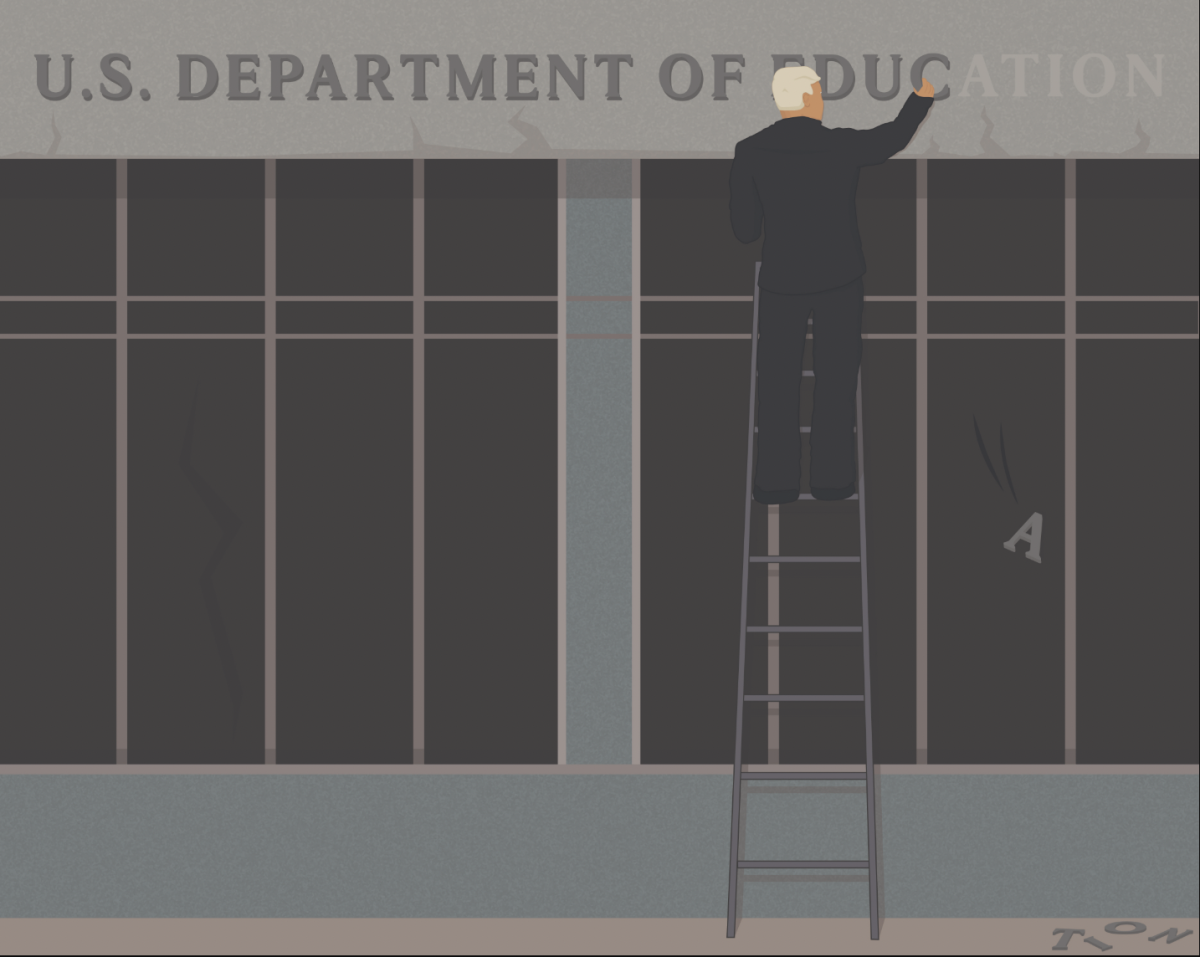

Finally, tax season’s complications provide no benefit to the consumer, the government or accountants. In fact, no one really benefits from the chaos except for large tax filing companies. Intuit, the financial software company that runs TurboTax, spent more than $2 million in lobbying the U.S. government in 2016, much of which was against pre-filled tax returns.

H&R Block spent around $3 million, some of which went to the same legislature. These companies are invested in maintaining the status quo of the tax system due to the profits they make from their software and tax services, but the status quo does little to benefit the average American, who will not be seeing any of these profits and often find themselves spending money they would not have under a more efficient system. Working toward a simpler system may hurt the bottom lines of these companies but will improve the lives of Americans.

However, despite the major inconvenience to all parties, not everyone is in favor of major tax reform. Some politicians believe that taxes should be an inconvenient process because then you will be reminded that the government is taking your money. Former president Ronald Reagan famously opposed legislation that proposed state tax withholding in 1971 during his tenure as governor. He claimed that it would make it easier for the state to increase taxes with fewer opportunities for protests from citizens, and even claimed that “taxes should hurt.” While he later signed the bill he originally opposed, many of his cohorts maintain that the unwieldiness of the current tax system allows Americans a greater awareness of any changes to taxation.

While the amount of taxes that are considered ethical can be debated, it seems silly to make taxation complicated as a permanent reminder of the ills of the system. It would be akin to taking out air conditioners in cars to remind drivers about the negative effects that commuting has on the planet.

The bottom line, the income tax system needs serious reform and if it is implemented, almost every American will see an increase in their tax filing experience.

-Tiara Allen is a marketing senior

The University Star welcomes Letters to the Editor from its readers. All submissions are reviewed and considered by the Editor-in-Chief and Opinion Editor for publication. Not all letters are guaranteed for publication.

Opinion: Filing taxes is too complicated

Tiara Allen, Opinion Contributor

April 18, 2022

0

Donate to The University Star

Your donation will support the student journalists of Texas State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover