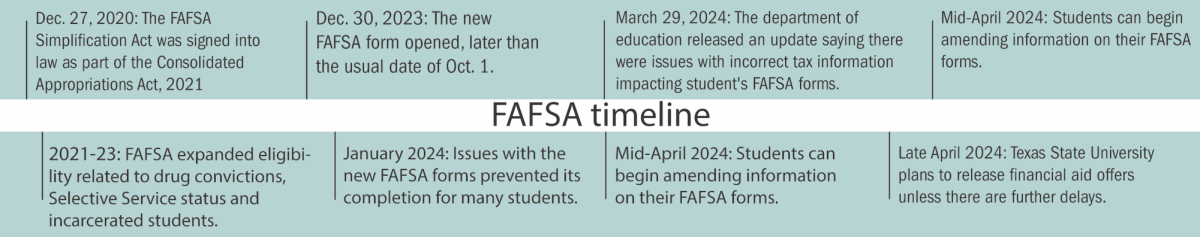

As the Free Application for Financial Aid (FAFSA) form is pushed back further, the effects of unreceived financial aid is felt across campus.

According to the Federal Student Aid (FSA) department, the FAFSA form went live on Dec. 30, differing from the normal Oct. 1 date. Now, although universities usually expect to receive financial aid data from students as early as October, Texas State and higher education institutions will not get the data until at least mid-March.

“Based upon estimations for completing that work, the department will begin transmitting batches of FAFSA information (ISIRs) to schools and state agencies in the first half of March, which will include the updated Student Aid Index (SAI) tables,” a Jan. 30 FSA announcement said. “We anticipate catching up with the majority of ISIR transmissions to schools in the weeks following the beginning of ISIR delivery.”

The SAI is a number universities use to determine the amount of federal aid a student will receive. According to the FSA, it is calculated through adjusted gross income, deductible payments, tax-exempt interest, untaxed portions of IRA distributions and pensions and foreign income exclusion.

As students are left with less time to decide on their education plans, this can possibly impact enrollment for the upcoming semesters, according to Terrance McClain, director of the Student Success Center.

“If it doesn’t get resolved, we’re probably going to see a decrease in enrollment,” McClain said. “I think that’s the bare bone basics of it. Their education is being impacted even if they do a payment plan or take less hours. Their graduation plan can be affected as well.”

According to the Feb. 6 email from Damphousse, enrollment for the spring semester rose by 3%. This increase is threatened to lower due to the delay.

One financial aid opportunity that will be widely impacted by the delay is the Pell Grant. The Pell Grant is determined through the FAFSA form and is awarded to students who demonstrate exceptional financial aid. However, since the FAFSA data is delayed, the time students have to receive the grant and decide on pursuing higher education lowers.

“Without FAFSA information, students and their families are in limbo and not able to make financial decisions about attending or staying in college,” a Feb. 6 email from Texas State President Kelly Damphousse said. “The later Texas State receives this information, the less time prospective and current students have to weigh their college choice options. This is especially concerning for low-income and first-generation students. To put this in perspective, more than 54.8% of our [first-time in college] undergraduate students are federal Pell Grant eligible this year, so this delay could potentially be devastating for their dreams of a college education.”

Ashley Chasco, a political science freshman, is filing as an independent for the first time this year. This means the FSA will not use her parents’ financial information to determine aid. The FSA reviewed her application, meaning she is waiting before she can make any decisions on her future at Texas State.

“I’m just frustrated because I’m not sure if they’re gonna approve of me being independent,” Chasco said. “I’m not sure how much they’re gonna give me and I have to find a way to pay for school.”

According to Damphousse’s email, Texas State is making plans to help students with the delay. The university will announce merit scholarship awards sooner, allowing students to have a clearer financial picture before the FAFSA data is released.

Texas State will discuss increasing the adjusted gross income (AGI) level for students to qualify for Bobcat Promise, which covers tuition and mandatory fees for incoming freshmen who take 15 credit hours or more per semester. Currently, the AGI level is at $50,000.

McClain recommends students consider using a payment plan to make it easier to pay, which requires a 25% payment of university dues at the time of enrollment and three additional payments at designated due dates.

Despite the frustration felt by the student body, Damphousse said this being a federal issue might bring a sense of peace to some minds.

“The only comforting news is that every university in the country is facing the same problem,” Damphousse’s email said.