For many students, managing money can be difficult when they have monthly payments on things like student loans, bills and living costs. Every month, the University College hosts several financial literacy events on credit awareness, money management and budgeting, as well as provides advice on personal finance management.

Terrance McClain, associate director of Success Coaching, said students should know the importance of practicing good financial literacy.

“For the overall population, a lot of students don’t know about [credit]” McClain said. “A lot of our events that we do we try to incorporate the basic things like credit score, how to develop a good one, and things to look out for.”

McClain urges students to use the resources at their disposal and seek help if needed.

“There is a lot of students that have the knowledge, but the majority needs help,” McClain said. “We cover main things like credit, budgeting and student loan repayment. We want to help students, that’s our main goal, we know how hard it can be.”

The University College plans to continue its financial literacy events to lead up to April which has been deemed Financial Literacy Month by the U.S. Senate. The month highlights the importance of financial literacy and tips to become financially smart.

Texas State and its partnership with Randolph-Brooks Federal Credit Union will celebrate on April 11 with events that incorporate fun activities with expanding personal finance knowledge for students.

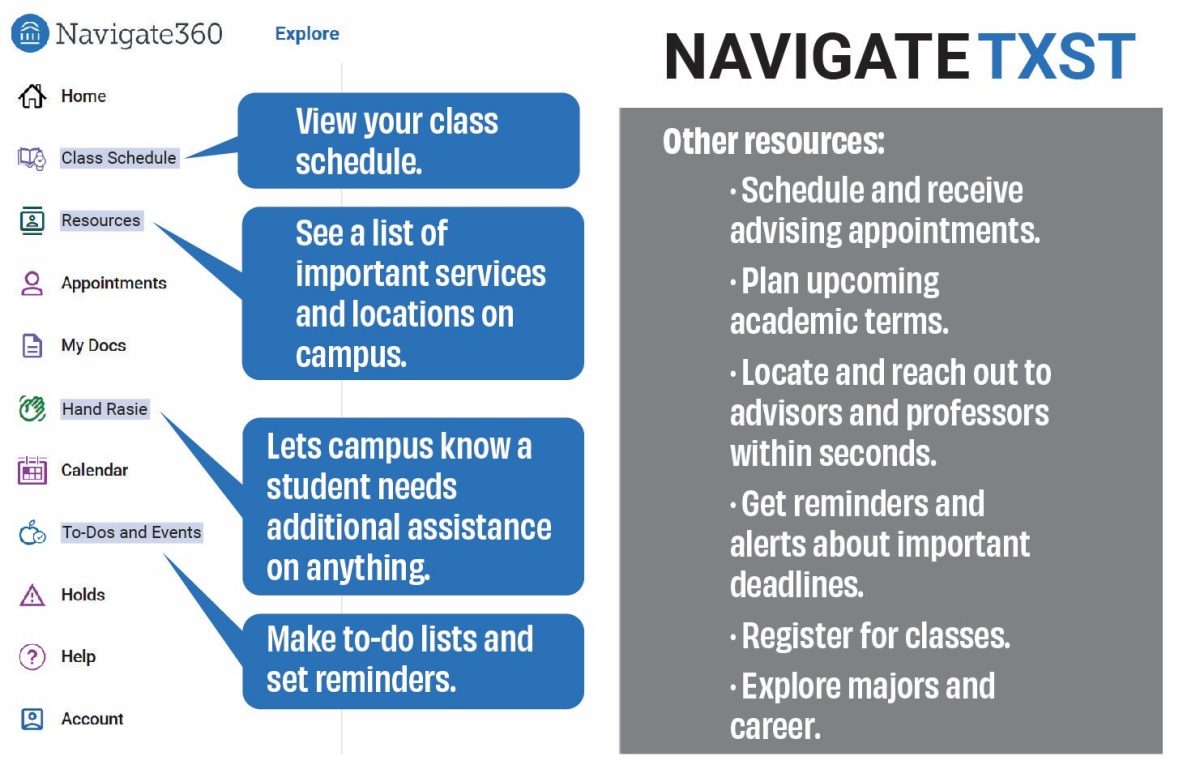

Students can use other resources provided by the university before April.

A LendingTree survey from March 2020 explains that more than one out of every five students take out extra student loans to pay for spring break. Texas State’s spring break begins on March 12 and runs through March 19. The University College will host a spring break budgeting event on March 7 to teach students about money management and being financially responsible during the break.

According to a U.S. News survey, as of Sept. 2022, 46% of college students who own credit cards have accumulated some sort of credit card debt. On average, students in the U.S. have more than $3,000 worth of credit card debt.

Credit is used for many things in life such as buying a home, car or other major appliances. The process is like gaining trust. The better a person’s credit is, the more companies and banks will trust someone to use their money.

Pondra Zigler, an accounting sophomore, said that she does not believe many students know about credit cards and financial literacy.

“I know a lot of my friends don’t have credit built up yet so I’m sure that’s common,” Zigler said. “I think can be a good thing to some extent because if they aren’t educated properly on credit, they could destroy theirs.”

Credit can also determine how much one will spend on a major purchase, someone with good credit will pay significantly less to a company versus someone with bad credit. Bad credit can cause serious financial hardships like fewer loan options, high interest rates and can even affect job opportunities.

According to the Government Accountability Office, “the disadvantages of credit cards can outweigh the advantages” if students do not know money management and financial literacy when it comes to building a credit score with a credit card.

Zigler said her advice to students who lack financial literacy or need to start credit is to make sure their finances are in order.

“I would advise students that don’t have credit already to do a lot of research before they start,” Zigler said. “They don’t want to hurt themselves by going into debt in the long run.”

Kats Jimenez, a history senior, said that students should be careful with credit card companies since their advertisements can be misleading.

“They take advantage of some students’ lack of knowledge to offer cards that would ruin their life down the road,” Jimenez said. “Just because you have money on your card doesn’t mean it’s a great idea to spend on everything and anything that you like.”

Her advice for students like her is to ask for help and use resources appropriately.

“Take the time to research these credit card companies, it’s better to be safe than sorry,” Jimenez said. “Don’t hesitate to ask around too, and attending a financial literacy session may help with not feeling alone.”

McClain said students should use other resources outside of Texas State to understand financial literacy.

“Utilize free opportunities that you have. Go read books in a library, go watch YouTube videos, go to TikTok,” McClain said. There are multiple ways for you to learn about the information, and something is better than nothing.”

For more information about the University College and it upcoming events, visit its website.

TXST, partners strive for student financial literacy through college

February 24, 2023

Donate to The University Star

Your donation will support the student journalists of Texas State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.