Attending college is a staple implanted into the minds of young people, forcibly promoting the idea that college will somehow bring permanent economic stability and an easy life. But more often than not, people are ill-prepared for the debt that comes with college.

Amid a pandemic and a damaged economy, student loans should be forgiven, propelling those in debt to focus on their livelihoods and moving ahead to attain a stable lifestyle.

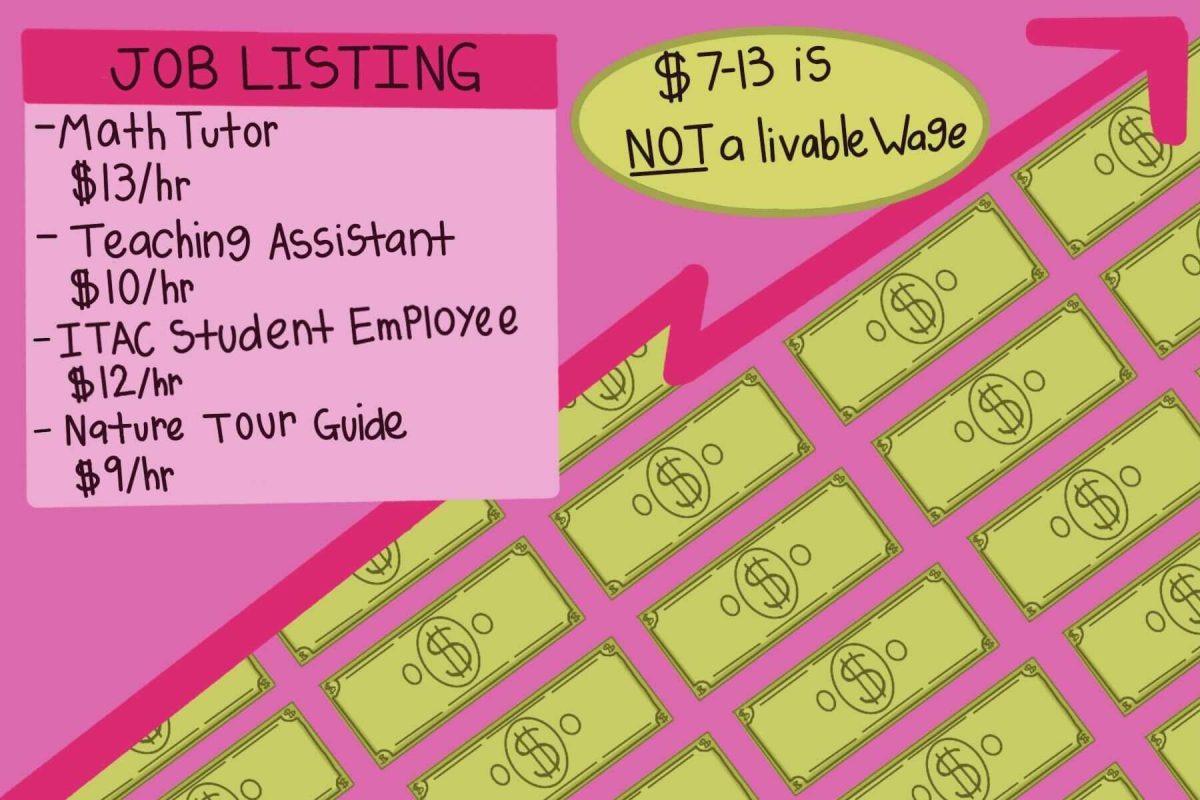

In the U.S. alone, student loan debts average about $37,584 for each borrower. A Texas State graduate can expect to earn an average of $39,575 a year, just barely over $2,000 of her, his or their assumed debt. One of the most popular methods of financing a college career is through federal loans. Federal loans are to be paid back shortly after graduation, during the time in which the recent graduate is expected to have found a steady job and income to live off.

For adult, professional, community education (APCE) graduate student Sarah Roark, student debt is a familiar subject. Though fortunate enough to graduate with minimal debt, the loans accrued throughout her graduate program will leave a significant impact on her life post-graduation.

“I came to Texas State, and I didn’t realize that graduate students aren’t offered very much aid,” Roark said. “At this point, I’m completely dependent on loans. They made it so easy for me to take out the loans; it was just right there—I didn’t expect it to be that simple. I don’t think a lot of students really think through that part; they just see the money and think it’s easily accessible. They just make it so easy, and they don’t really explain how [federal loans] work. [Students] don’t understand the weight, and the interest it accrues.”

Thankfully, executive actions have allowed graduates to have some relief from their student loans. With payments deferred until Dec. 31 this year, new alumni can make the most out of their income and put the focus where it matters in the middle of a seemingly never-ending pandemic: Food, shelter and general health.

President-elect Joe Biden declared he would eliminate student loan debt should a student or recent graduate make less than $125,000 per year, woefully inciting a multitude of negative reactions from the general public. He also reassured that $10,000 would get “knocked off of their student debt,” a gracious maneuver that has been met with both vitriol and praise.

The negative consensus of Biden’s plan poses a simple argument: If people have been able to pay their student debt off entirely, why should debt be canceled for the future generation of graduates? Frankly, it is unequivocally selfish to deny future graduates a feasible chance at economic stability post-graduation.

“I’m all for [canceling student debt],” Roark said. “I knew that going into education, it’s not a very lucrative field, and I would struggle to pay my loans back. If this was granted for me, it would completely change my life. I think a lot of people feel the same way. Look at people in the STEM field, where they go through a lot of school before they even get to their respective field, those people end up with a lot of debt. This would be so helpful to millions of students.”

The economy continues to change, and the U.S. is facing one of the worst periods in history due to the pandemic. With vaccines on the way, the hopes that the country will recover its previous job market lingers. For now, graduates will continue to glean debt but no economy to partake in, leaving them to either find careers that do not pertain to their degrees or jobless altogether.

“I told [my friends] that [college] is worth it in the end,” Roark said. “You’ll end up getting a better job and paying it back eventually. There’s always been this hope that student debt would be forgiven—I’ll definitely be in quite a bit of debt when I graduate, and I’m okay with that.”

By forgiving student loans, higher education becomes attainable to those who normally cannot afford it. Education should be a right not limited by a staggering amount of loans, and wanting to avoid debt should not be a factor in why someone decides not to pursue a degree field she, he or they are passionate about. In fact, providing attainable and affordable education to those who wish to seek a degree opens up educational opportunities for disadvantaged communities.

On average, lower-income communities have more crippling federal loan debt, leaving them to struggle after graduation. Low-income students are also disadvantaged with typically having to juggle both a full class schedule and work hours to have sufficient funds to pay off student loans. Forgiving student loans would allow students to thrive within their academia, providing them a far better chance at finding a coveted job post-graduation.

Student debt also factors into drop-out rates. This leaves a large inequality gap between those who have the privilege to either pay for college with minimal debt or no debt whatsoever.

A delicate balance must be achieved, and the scale is tipped far too much to the wrong side of policy. Forgiving student loan debt would allow for extra money to be slowly funneled back into the economy and bring stability to households that yearn for it as well.

“I think that there’s so much government funding that is allocated in ways that aren’t as helpful to the everyday person,” Roark said. “Doing this would help fuel the economy, there’s no doubt about that.”

Besides, the economy is not nearly parallel to that of the last decade—and it was not great then, either. A college graduate now cannot pay off a mortgage feasibly off of an entry-level job’s salary, nor can a high school graduate find a job that pays the bills comfortably. The unfortunate reality is that college degrees are waning in their worth, with the job market not offering sufficient compensation for the level of work and skills required for a job.

Attending college does have a myriad of benefits that stimulate growth and maturity among a new generation, but the debt that one must succumb to is questionable—for right now, millions of people remain unemployed, and graduates find themselves applying frantically to a shrinking job market.

Forgiving student debt is not just a gift—it is an opportunity to allow recent graduates to grow and focus on their fields, further honing in their skills and earning hands-on experience in their prospective job market. There is nothing shameful in giving help to those who need it, and college students are among the demographic which needs the most help to advance economically.

Although it may not be a permanent solution to the economy’s current problems, forgiving student debt is a long-term treatment that could bear fruition toward the road to propelling a new generation of college graduates—a new generation of successful Bobcats.

With motivation and no crippling debt hanging over the heads and credit scores of soon-to-be college students, the hope that higher education is achievable grows, further inspiring students to tackle the real world after college—this time, with all of the resources and opportunities available to them.

– Valeria Torrealba is a public relations junior

The University Star welcomes Letters to the Editor from its readers. All submissions are reviewed and considered by the Editor-in-Chief and Opinion Editor for publication. Not all letters are guaranteed for publication.

Opinion: Student debt should be forgiven

Valeria Torrealba, Opinion Columnist

December 2, 2020

0

Donate to The University Star

Your donation will support the student journalists of Texas State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover