President Joe Biden’s plan for student loan cancellation is a start at addressing a national issue but is not sufficient.

The president’s proposed plan is specific. $10,000 would be erased in federal student loan debt for those with incomes below $125,000 a year or households with incomes below $250,000. Borrowers who received federal Pell Grants are also eligible for an additional $10,000 of relief. This plan will affect 43 million, but will only wipe out the debt of about 20 million, less than half.

This relief will undoubtedly lift the weight of financial stress off of students of color, first-generation graduates, those with low-income levels and students affected by the equity gap. Unfortunately, this part of the population is made up of students who are already graduating less than their majority peers. Black and first-generation students also tend to take out more student loans, which heightens the disparity.

The cost of college has risen by 1200% since 1980. As it continues to do so, the importance of higher education does too. In 1980, male high school graduates earned $44,200, while their higher educated counterparts earned $52,300. Twenty-eight years later, that gap has widened to just $32,000 for high school graduates and $55,000 for those who earned a bachelor’s degree.

The increasing pressure to attend college has not helped enrollment, as overall enrollment in undergraduate and graduate degrees has been steadily declining since 2012. Furthermore, remote learning and financial hardships from the pandemic have caused enrollment decline to be seven times worse than in spring 2019-2020.

At Texas State, we have set a record for freshman enrollment, uncharacteristic compared to the rest of the country. But the retention rate is 77%, below the rate at similar colleges of 84.5%. Not having to bear the weight of future loans with high-interest rates could help keep first-year students around long enough to do the essential thing: graduate.

There has been enough of a fear sparked by student loans to where there is counseling to prepare you for them. In addition, the cancellation of student debt will help enrollment. According to The University Professional and Continuing Education Association (UPCEA), the top reason a college student drops out is financial reasons. A plan that eases the stress post-graduation debt and will encourage dropouts to return to school.

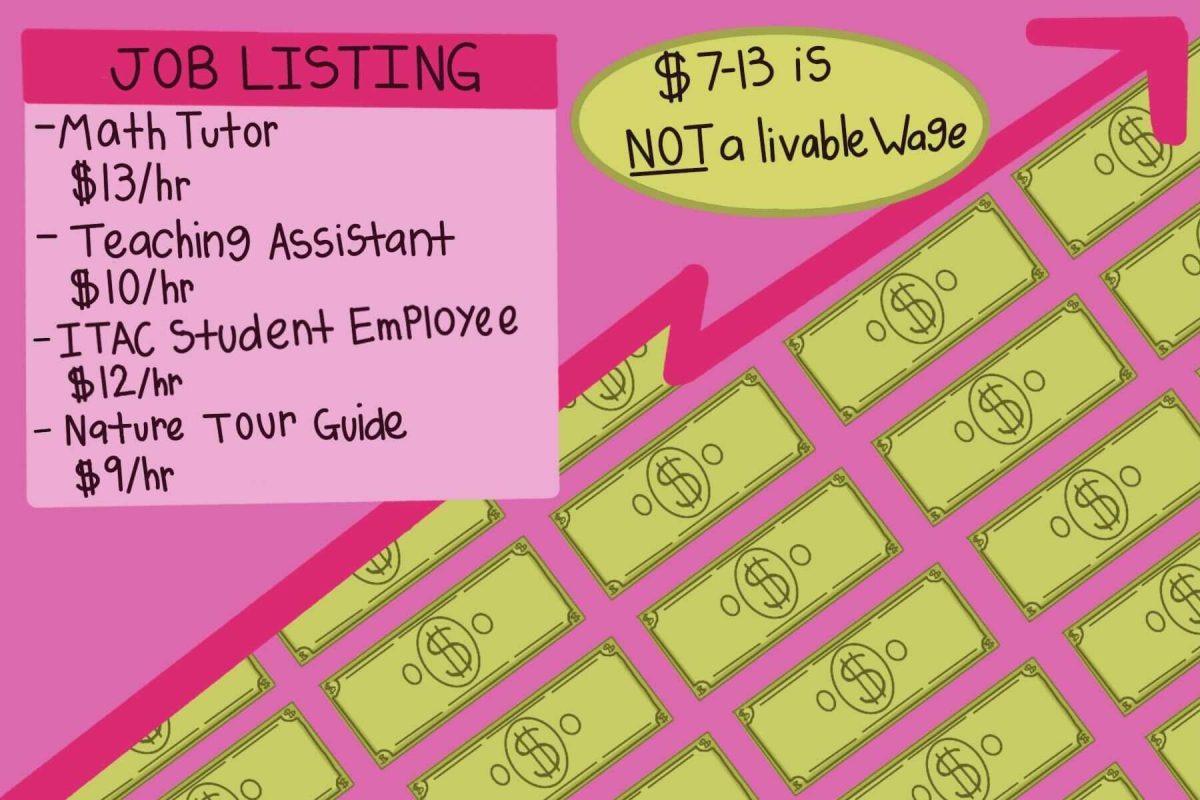

Most college students work because of the unaffordability of being a student. While there seem to be benefits to working in college, like earning higher pay after getting your degree, there tends to be a line. If a student works more than 15 hours a week, their grade point average tends to drop to a C or lower, while those who can work 15 or fewer have a B or higher. Education goals should not be delayed because of the necessity of a job.

Texas republican detractors will say that it will come out of your pocket through taxes in a state with no state income tax. Loans have also already been not being paid since March of 2020. Fox News was also quick to point out, as they usually do, the national debt, which rose $7.733 trillion under former president Donald Trump. This debt is being taken away as a stressor to a part of the population that needs financial stress relief, just not to the fullest.

In 2020, student loan debt reached a record $1.6 trillion. This debt will be knocked down, allowing a generation stuck renting because of said debt to recover and possibly become first-time home buyers. But it is only a start at addressing the mass issue.

Under this plan, nearly eight million borrowers will have debt wiped out without lifting a finger. It is also extending payments until January for those who still have payments. Also, those who have been making payments for ten years and have a balance of $12,000 or less will have their debt wiped out. It also caps undergraduate loan payments to 5% of the borrower’s monthly income, less than the 10% it previously was.

The impact on a specific population of Americans now emerging from a pandemic should be clear. However, that population is also seemingly excited as they crashed the Federal Agency for Student Aid (FAFSA) website after hearing the news. While it may not be sufficient and more can be done, it is still something and will significantly affect those who receive it.

– Dillon Strine is a journalism senior

The University Star welcomes Letters to the Editor from its readers. All submissions are reviewed and considered by the Editor-in-Chief and Opinion Editor for publication. Not all letters are guaranteed for publication.

Opinion: White House’s loan forgiveness does not go far enough

Dillon Strine, Opinions Editor

August 31, 2022

0

Donate to The University Star

Your donation will support the student journalists of Texas State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover