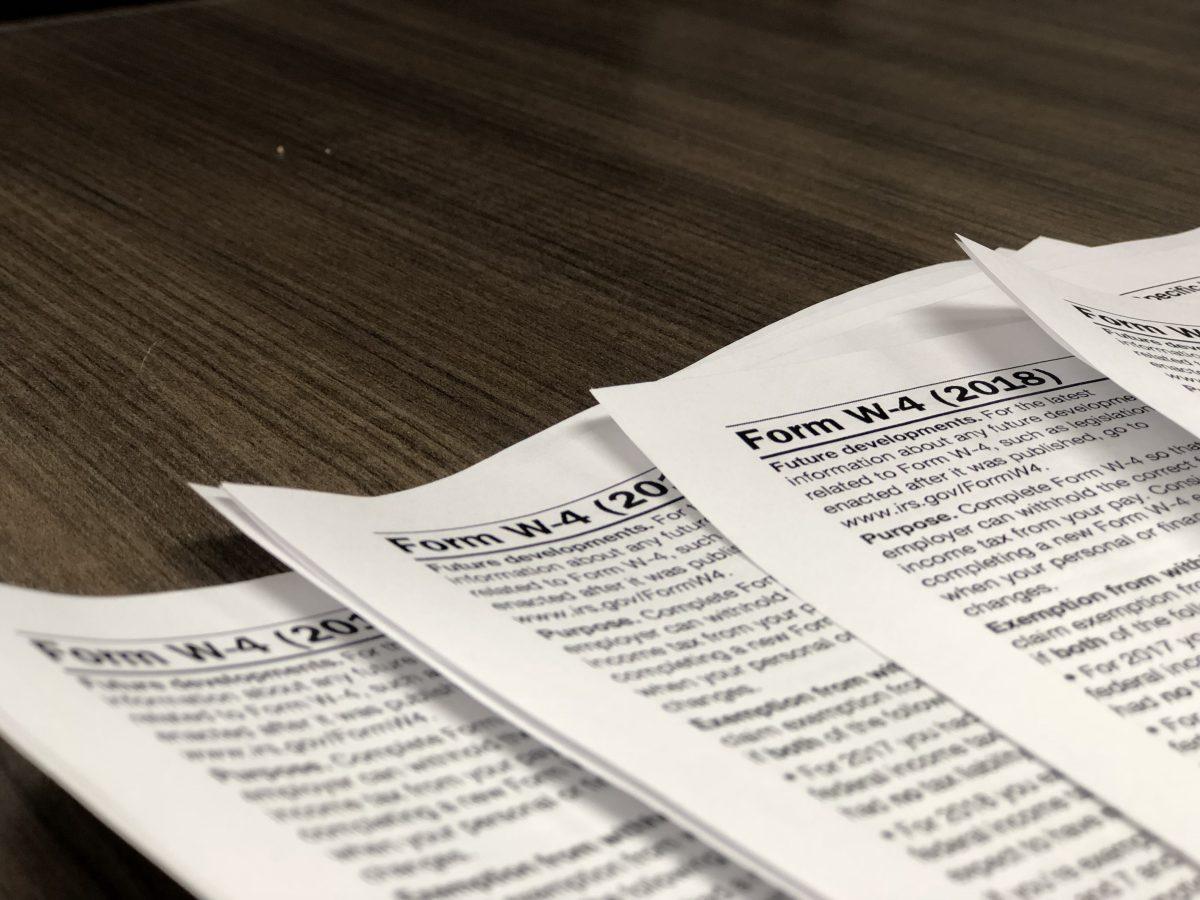

Springtime is a time of renewal, growth and the fresh smell of taxes.

Making sure all tax forms are accurate and filed on time can be a stressful experience for students. However, there are many tax specialists, including some on campus, to provide help.

Katelyn Disney and Melanie Schubert, graduate accounting students, work with Texas State’s Volunteer Income Tax Assistance Clinic. The VITA is a national service with thousands of clinics across the country. The Texas State clinic is an annual campus program run by certified volunteers to help qualifying individuals prepare and file their taxes.

Disney said students should check if their parents are claiming them as a dependent before filing their own return.

Mercedes Roth, H&R Block tax associate and senior accounting major, also said this is a common mistake she notices among students.

“Students whose parents still claim them can’t claim their education benefits,” Roth said. “I know a lot of students who go in and file their taxes and they claim themselves, but then they have to come back to file an amendment return and show that their claim was a dependent so their parents can actually get those tax benefits.”

Roth suggested visiting a tax professional when claiming student benefits, as there are many forms to file on the return that may become overwhelming.

“There’s a lot of additional work that you have to do and a lot of students don’t know that so they just put in the information that is on the form and then a couple weeks later, they get an audit letter,” Roth said. “Not everyone gets caught from the IRS, but it’s better to be safe than sorry.”

Roth said to keep all receipts and records from purchases of school related materials in case an audit arises.

Schubert said it is important to be adequately prepared for the filing process, even when expecting a small tax return.

“It is important to make sure you have all your tax documents together before filing,” Schubert said.

Roth said it is essential everyone knows how to file their taxes upon leaving college because it is a useful skill that will follow students for the rest of their careers.

“I think everyone should have a basic understanding of taxes so that way they’re not just going through the tax return on an online service like Turbotax,” Roth said. “Everyone should at least have a common understanding of their taxes because you’re going to be filing a tax return every year for the rest of your life as long as you’re working.”

The annual VITA Clinic is available at Texas State, held in LBJ 3-6.1, and provides free tax assistance to those who qualify. Information regarding the required documentation for the VITA clinic can be found on their website. H&R Block also offers a refund transfer deal where there is no need to pay fees upfront because the fees will be deducted from the tax return.