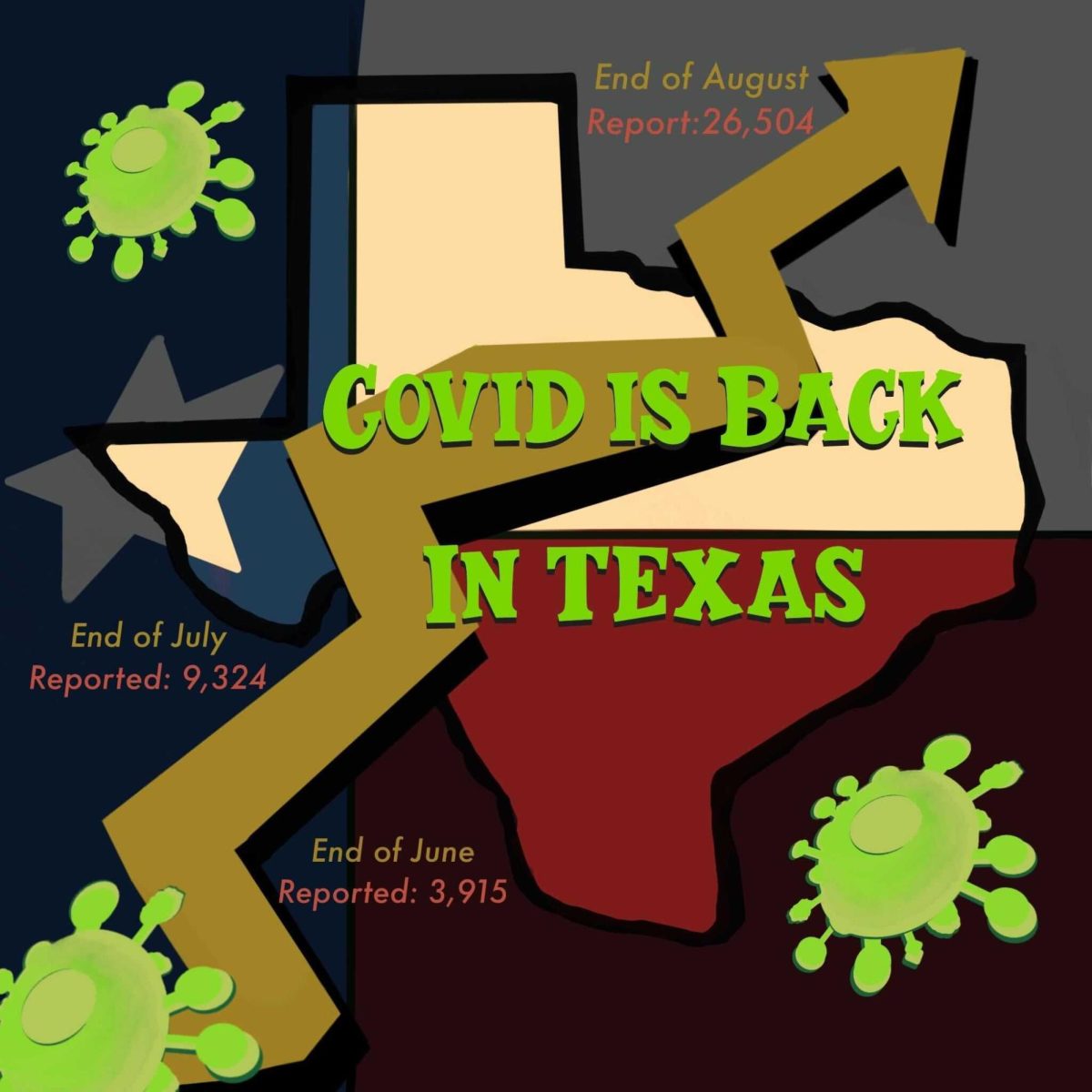

The San Marcos City Council approved the city’s municipal budget Sept. 15 for Fiscal Year (FY) 2021, taking into account a number of issues caused by COVID-19 during its development.

City staff’s development of the budget was guided by five strategic initiatives established by the City Council: Workforce Housing, Multi-Model Transportation, Workforce Development, Downtown Vitality and City Facilities.

For the new fiscal year, which began Oct. 1, 2020, and will end Sept. 30, 2021, revenues are expected to increase by 6.6%, from $239.8 million to $255.8 million. However, expenditures are expected to increase from $239.1 million to $258.7 million—an 8.2% rise—meaning the city’s expenditures outweigh its revenues for FY 2021.

The city will make up for this difference by using money from its fund balances, or excess funds from previous fiscal years that have been placed into a reserve. Assistant Director of Finance Melissa Neel says the city can afford to do so because it has exercised financial caution in the face of COVID-19.

“We have been extremely conservative this year through all the expenditure reductions that we took part in back in March,” Neel said. “Fiscal Year ’20 revenues came in higher than projected, although we had been planning for kind of a worst-case scenario.”

Still, some local officials are not happy with the city’s use of fund balances to pay for expenditures, such as councilmember Saul Gonzales.

“The reason I’m supporting this is because of [COVID-19]—our budget took a hard hit this year, and we had to go into our reserves,” Gonzales said. “I still say that…we’re going to have to start living within our means.”

Additions to the city’s general fund include $500,000 to fire and police, $700,000 to non-civil service employees and $533,000 for Emergency Medical Services funding and expansion of service. However, COVID-19 left the city with very little to spend on social services, according to city councilmember Maxfield Baker.

“The reality is that when things end up on the chopping block, we have our core services that it’s really hard to pull any money from—you know, firefighters and police officers and health responders—so that leaves us really looking at events like Sights & Sounds (Christmas event) or how much money we give to the Chamber of Commerce, the Greater San Marcos Partnership,” Baker said. “We even considered how much we can justify in raises for this coming year.”

However, Baker says this forced careful consideration of budgeting tactics has been helpful in that it has allowed city officials to examine more critically what programs need funding and which do not.

“We give nearly $100,000 to Sights & Sounds, and it’s no longer a free event for everybody,” Baker said. “People have to pay to get in there, businesses are making money in there, it’s put on in part by all these donors and organizations. Should the city—now that Sights & Sounds has kind of grown into its own probably profitable business—do we need to keep funding things like that? I would say the answer is no.”

The budget reduces the tax rate from $0.6139 per $100 of appraised property value to $0.5930. Despite this decrease, the city will raise more tax revenue because of increased property appraisals, which are up 11.3% from 5.64 million to 6.27 million. The new rate will save homeowners money, according to Neel, who says homeowners with homes valued at $200,000 will pay $42 fewer in yearly property taxes.

Although property tax revenue has increased, sales tax remains the city’s largest source of revenue; the city raised $42.39 million in sales tax revenue last fiscal year and is expected to generate $39.08 million this fiscal year. This reliance on sales tax raised concerns when local businesses began to close due to COVID-19, but according to Neel, a surge in internet sales taxes made up for the loss in sales tax revenue from physical stores.

“During the pandemic, when most of your brick and mortar stores were forced to be closed and shoppers were forced to go online to purchase their products, a lot of that sales tax diverted to where those products were being shipped or some of the businesses that we have in town that conduct internet sales,” Neel said.

Many utility rates will increase under the new budget: Water by 5%, wastewater by 3%, stormwater by 6.5% and solid waste and recycling by 3%, for a total average monthly bill impact of $5.31.

The budget can be viewed in full on the city of San Marcos website.

April 25, 2024

April 25, 2024

April 25, 2024

April 25, 2024

April 24, 2024

A look at the San Marcos City Budget for 2021

Carson Ganong, News Reporter

October 19, 2020

Donate to The University Star

Your donation will support the student journalists of Texas State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover

SECTIONS

SERVICES

CONTACT INFORMATION

universitystar.com

601 University Drive

San Marcos, TX 78666

Phone: 512-245-3487

Email: [email protected]

601 University Drive

San Marcos, TX 78666

Phone: 512-245-3487

Email: [email protected]

© Copyright 2024 The University Star 601 University Drive, San Marcos, TX | Privacy Policy

© Copyright 2024 The University Star 601 University Drive, San Marcos, TX | Privacy Policy