It is no secret that many college students struggle with money. The average income of most students will fall between $4,000 and $11,000 dollars a year according to LoveToKnow.com.

In a 2014 study, seven out of 10 seniors who graduated from a public university had an average student loan debt of about $30,000. After some math, there is not much money left for essential needs like toiletries, groceries or fun activities.

Here are five ways students can save money this spring.

Meal Prepping for convenience

Eating out may not seem like an expensive habit in the moment, but after a while those meals can add up. One Fuego taco is about $4. If one student gets two tacos from Fuego on every visit, and revisits for both lunch and dinner daily, that adds up to more than $100 a week in Fuego tacos.

Meal prepping can help avoid this kind of disposable spending. Buying ingredients that can be put together to make a variety of different meals will give a student different food options throughout the week. This can decrease the amount of money spent at restaurants like Fuego or Whataburger.

Tracking with a journal

Writing down how much money one spends can help students realize how much they are spending. Every time a card is swiped or cash is exchanged, writing what was bought and how much of it was bought can help students create a spending-log.

Sierra Gonzalez, Texas State alumna, said she feels like the first step in taking control of finances is knowing where the money is going.

“Start keeping a journal of your spending if you use cash. It’s easy if you use debit, primarily because most cards can show you your statement,” Gonzalez said. “Once you know where your money is actually going, you can see where you can save.”

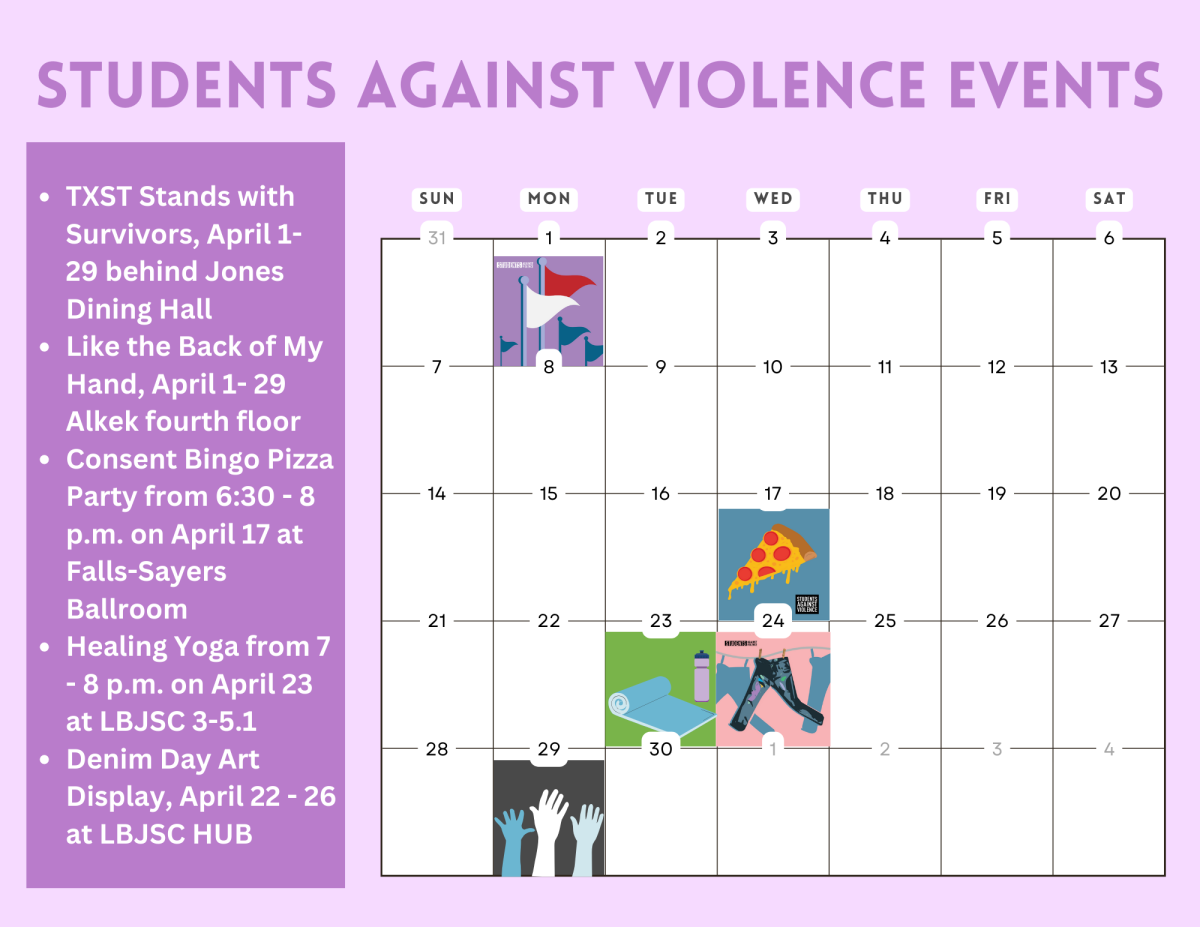

Taking advantage of free opportunities

Maybe weekend trips to the Square and Sixth Street are getting a little costly, both in gas and at the bar. Dollar Dos Tuesdays are not enough to save students from the intensity of the bar tabs. Replacing some of these weekly activities with free ones can help save a little bit more.

Mary Kate Tischler, public relations graduate student, said she adopted some self-care regimens that took up her free time so she would not spend as much money.

“I would meditate, go for a hike, take a bubble bath, give myself an at home facial, have girl’s night in, have Game of Thrones marathons at my house,” Tischler said.

Carlos Salinas, psychology senior, said he tries to avoid using his debit card.

“I always try to have a little cash on me,” Salinas said. “Enough to enjoy my time out but nothing less that could cause me to use my card.”

Adopting the 25 Percent Rule

Saving money sounds great, but learning how much to save and how often can be tricky. The 25 Percent Rule can help portion out finances. Each time money is received, take 25 percent of it and put it away and do not touch it again until the time has come.

Jasminh Abor, Spanish senior, said this tactic helps her stay on top of bills.

“Pay bills first and pay your savings first. Then use the extra money for whatever,” Abor said.

Alli Robinson, interdisciplinary studies sophomore, said she stores money in her savings for a month and then allows herself to use it the next month.

“This is the plan I have been using since the start of my freshman year and if I continue with this plan of mine, I will graduate debt free with some extra (cash),” Robinson said.

Even if financial stability seems difficult, it can be achieved through careful yet realistic planning and persistence.